From Dow Jones: Home-Remodeling Spending To Fall 4.8% Through ’08 – Study

Home-improvement spending is unlikely to improve until 2009, and the second half of 2008 is shaping up to be weaker than the first, according to Harvard University’s Joint Center for Housing Studies.

Falling consumer confidence and a weakening economy are inhibiting remodeling spending, which is expected to fall by an annual rate of 4.8% through the end of 2008, the center said Thursday. That is steeper than the 2.6% annualized decline the center projected through the third quarter when it last updated its Leading Indicator of Remodeling Activity in January.

This might be optimistic for several reasons. First, falling house prices and the inability for homeowners to borrow against their homes (mortgage equity withdrawal) are probably “inhibiting remodeling spending” more than the weakening economy and consumer confidence.

Second, we have recently seen warnings from Home Depot and Lowe’s that suggest same store sales are falling off a cliff (about 8% year-over-year).

And third, the Joint Center for Housing Studies forecast is mild compared to declines in home improvement spending during previous housing busts.

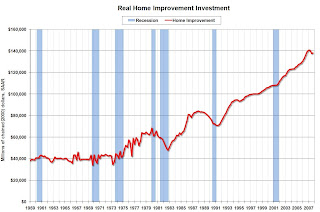

This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue (source: BEA)

As of Q4 2007, real spending on home improvement had held up pretty well (only off 2% in real terms from the peak). If this housing bust is similar to the early ’80s or ’90s, real home improvement investment may very well slump 15% to 20%.

Yes, the Joint Center for Housing Studies forecast is in nominal terms, but it appears they believe this slump in home improvement will be milder than the downturns during the previous two housing busts (early ’80s and early ’90s).

Ben Larrabee says

I’ve only been reading “Making Cents” for a short while, but I’ve found it to be quite enjoyable, and I don’t understand why you don’t have more comments. Keep up the good work.