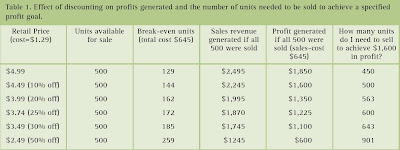

In the most recent OFA Bulletin (Jan/Feb 2008), Behe and Dudek presented an article that reinforced the negative impacts of retailers discounting prices needlessly. Using prices collected from Michigan garden centers, the authors demonstrate the WIDE variation in pricing for similarly-sized products in the same trade area. The analysis showed that significant dollars can be left “on the table” from under pricing — using price as the single mechanism used to attract customers (see Table 1 – click on the table to view in larger format).

However, the same data can be used to demonstrate a significant reverse corollary. Recall that in an earlier post, I talked of the inelasticity of demand and that if firms successfully differentiate themselves from competitors in their local trade area, they are able to raise prices and though they may sell fewer units, total revenue for the firm actually increases.

Using Table 1 data, assume that the current price is $3.99 per unit (which requires sales of 162 units to break even and generates sales revenue of $1,995). If price per unit is increased to $4.49 (a 10% increase), only 144 units are needed to break even and profit rises to $2,245. In similar fashion, an additional 10% increase in price translates into even fewer units to break even and another increase in sales revenue.

Ceteris parabis, holding all other things constant, profit rises as well. So what are you waiting for?