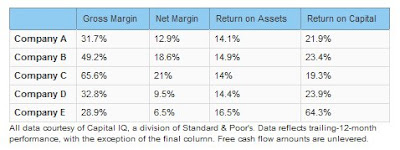

Let’s proceed with a game I’d like to call … Pick the Profiteer! Your choice will indicate the industry that’s clearly making more than its fair share. We’ll tax those excess profits to subsidize the unreasonable prices that consumers pay for the industry’s products. Sound good? Here are your choices: Take all the time you need.

Take all the time you need.

Ready to tax that windfall? That was pretty easy, right? Clearly the oil company is C, the one making the most money off of every dollar of sales. Nope! Actually, that’s Coca-Cola (NYSE: KO). And B, the company with the second-highest margins, is 3M (NYSE: MMM).

Hmm. Fine, then it must be E, right? It is, after all, the company earning the most relative to the amount invested in the business. Sounds like excessive profitability to me! Well, that would be Accenture (NYSE: ACN).

Let me stop you — it’s not A, either, which I should note also happens to sport the highest free cash flow growth among the five. That would be Apple (NYSE: AAPL). Whichever “parasitic” company you chose, I hope you’re ready to fire off a missive to your senator, demanding an excise tax on those rip-off Cherry Cokes, Post-it Notes, consulting contracts, or iPods.

While the sheer size of a company like Chevron (NYSE: CVX), company D, translates to some eye-popping profit numbers in absolute terms, I would hope this exercise gave you a little more perspective on Big Oil’s profitability relative to its large-cap brethren.

Thanks to Toby Shute for the game idea.