This article on pricing was recently posted to the Executive Adviser, a business journal put out by the MIT Sloan Management Review. It is well worth the read.

This article on pricing was recently posted to the Executive Adviser, a business journal put out by the MIT Sloan Management Review. It is well worth the read.

How will the current retail environment affect green industry sales in the spring?

Quick overview of some of yesterday’s December retail data (no real surprises):

Wal-Mart cut fiscal Q4 earnings target about 10%.

Costco posted a 4% drop in December same-store sales.

Family Dollar gained 8%; Same store sales gained 6%.

BJ’s Wholesale had 1.6% sales growth; the lowest in a year.

Sears (the largest U.S. department-store) sales fell 7.3%.

Target same-store sales fell 4.1%.

Macy’s December sales fell 4%.

Gap stores sales fell 14%.

Abercrombie & Fitch fell -24%.

Neiman Marcus reported a 28% drop off.

Limited Brands reported a 10% drop.

Also, a recent DJN press release states:

Food retailers are girding for a “battle” with vendors in the first half of the year as grocers push for lower prices to help shoppers through the recession and food manufacturers resist, Supervalu Inc. (SVU) Chief Executive Jeff Noddle said Wednesday.

With commodity and ingredient costs falling sharply in recent months, supermarket chains have been pushing for lower prices on everything from coffee to soups to help increase sputtering sales. In recent months, both Supervalu and competitor Safeway Inc. (SWY) have switched to a pricing strategy that sells more products at “everyday low prices” rather than relying on coupons or other promotions.

But food manufacturers have been reluctant to roll back their price increases, taken to offset higher input costs, despite some consumer product categories experiencing declines in sales volume of between 3% to 5%, Moody’s Investors Service said in a recent report on the sector.

Lastly, from Wednesday’s Business Week:

Shoppers are getting used to those 75 percent off sale signs, and that’s bad news for merchants who worry they will also have to quickly slash prices on spring goods to attract customers.

Anxieties about how rampant discounts have affected shoppers’ psyches and stores’ profits are running high…The deep price cuts are making shoppers question the true value of items.

My Commentary:

Obviously, all of the trends above begs the question of whether or not we are “training” consumers to be more price (discount) oriented that they have been in the past. Or, as a friend of mine put it…what is the longer-term psychological impact of the drastic price reductions of the holiday and post-holiday sales periods going to be on the going-forward consumer expectations and purchase behaviors?

Obviously, people are currently spending less than normal; certainly less than justified according to their actual incomes (they are saving more which is good in the long run but bad for the economy in the short run). They are also shopping smarter, focusing on the “value” they derive from each precious dollar spent. So as we have discussed before on this blog, those retailers that have their value proposition clearly delineated will be in a much better competitive position than those who don’t.

Without a doubt, several leading lawn & garden retailers are already positioning themselves for price-oriented competition this spring. We have always had a segment of consumers that are price-conscious shoppers and this will obviously bode well for them. Today’s economic environment may increase the number of these price-oriented consumers and the real question is by how much.

But the majority of our core lawn & garden consumer base have other things besides price in their value equation. The question is whether or not retail firms have successfully identified what THEIR key customer base truly values and are differentiating themselves accordingly.

Another key point to remember is that even though unemployment is at 7.2% (from today’s labor report), we’ll still have 93% of the workforce earning a wage. The monies not being spent now will eventually burn a hole in people’s pockets (if historical behavior holds true). It will probably take a few more months of spending declines for this hole-burning to take effect, so the economy will likely hit its low point this spring.

The key question then is whether “spring fever” will induce our core customer base to let go of those discretionary dollars burning a hole in their pockets. And, if so, will they be willing to pay the prices we must charge to cover the cost increases we’ve incurred in the last 2 years? Again, they are much more likely to do so if we appeal to their value equation.

It will also be very interesting to see how President-elect Obama’s yet-released-but-being-revamped stimulus plan is eventually structured and even more interesting to see how much of it is actually spent (historically only 20-40% of a stimulus is spent — the rest is saved or used to pay down debt). But fortunately, many folks will be receiving their tax returns about the time spring season kicks off, which means another influx of funds to burn a hole in their pockets!

Ok, now that we’ve discussed the retail environment, what does all of this mean for green industry growers? The tougher selling environment at the retail level this spring translates into a need to develop more intensive and collaborative relationships with your customers in meeting the needs of the end consumer – particularly in terms of their value proposition. During the downturn in 2008, those growers that proactively worked with their retailers (and usually these were pay by scan sales) to more closely provide landscape solutions for consumers were the ones who were most successful.

If any of you attended the recent industry webinar entitled, “It’s a Great Time to be in Business” you probably heard lots of great ideas. One of the best quotes that I wrote down during the webinar was “These are the times during which great companies are made.” Bearing that in mind, recall also that there are plenty of companies that have survived the last 50 years, which means they have gone through 11 such recessionary periods. How did they do it? By relentlessly focusing on and emphasizing their value proposition to their key customer base. There’s a great lesson there. What is yours?

Which windfall profits should we tax?

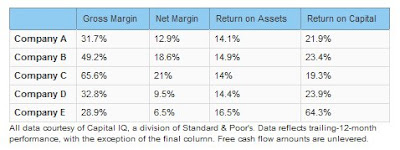

Let’s proceed with a game I’d like to call … Pick the Profiteer! Your choice will indicate the industry that’s clearly making more than its fair share. We’ll tax those excess profits to subsidize the unreasonable prices that consumers pay for the industry’s products. Sound good? Here are your choices: Take all the time you need.

Take all the time you need.

Ready to tax that windfall? That was pretty easy, right? Clearly the oil company is C, the one making the most money off of every dollar of sales. Nope! Actually, that’s Coca-Cola (NYSE: KO). And B, the company with the second-highest margins, is 3M (NYSE: MMM).

Hmm. Fine, then it must be E, right? It is, after all, the company earning the most relative to the amount invested in the business. Sounds like excessive profitability to me! Well, that would be Accenture (NYSE: ACN).

Let me stop you — it’s not A, either, which I should note also happens to sport the highest free cash flow growth among the five. That would be Apple (NYSE: AAPL). Whichever “parasitic” company you chose, I hope you’re ready to fire off a missive to your senator, demanding an excise tax on those rip-off Cherry Cokes, Post-it Notes, consulting contracts, or iPods.

While the sheer size of a company like Chevron (NYSE: CVX), company D, translates to some eye-popping profit numbers in absolute terms, I would hope this exercise gave you a little more perspective on Big Oil’s profitability relative to its large-cap brethren.

Thanks to Toby Shute for the game idea.

More on pricing…

An Economic Justification to Raising Your Prices

In the January issue of GrowerTalks, Chris Beytes provided us with some excellent case studies of firms that have recently raised their prices (great job Chris!). I think it merits repeating that the only way in which this makes sense economically is if the company successfully differentiates itself in the mind of the customer in terms of the types of products or services offered and the segment(s) of customers that are being targeted. It is a well-proven fact that customers use five different attributes in making a decision about what products/services to buy and from whom to buy them from – quality, value, service, convenience, and selection.

We economists characterize demand by a concept called the price elasticity of demand which measures the nature and degree of the relationship between changes in the quantity demanded of a good/service and changes in its price. An important relationship to understand is the one between elasticity and total revenue. The demand for a good/service is considered relatively inelastic when the quantity demanded does not change much with the price change. So when the price is raised, the total revenue of the firm increases, and vice versa. What this effectively means is that green industry firms can actually raise their price, and though they might sell fewer units of the product they are selling or the service they are offering, total revenue for the firm still goes up. So, the obvious question is this…how does one go about making their local demand more inelastic? The answer…by making the firm unique and different somehow in terms of quality, value, service, convenience, and selection! That’s why your marketing efforts are so important. They are the key to successful differentiation.

In summary, if your company is successful in differentiating itself from competitors, you are essentially making your firm-level demand more inelastic within your respective trade area and you can subsequently raise your prices and [even though you may sell fewer units] total firm revenue will still increase.

Now I can already hear the objections: “If I raise my price, my customers are going to defect and buy from my competitors.” Let me provide my own testimonial regarding this common objection to raising price. Over the last few years, all (100%) of the green industry firms that I have convinced [after much prompting and counseling] to actually try this have experienced an increase in total firm revenue. Not many, not most…ALL. Interestingly, some even found that per-unit sales actually increased when they increased their prices, which tells me they were pricing their products way too low to begin with. Low prices tend to result in a low quality perception in the mind of the customer and when you raise your prices, sometimes you can influence the price-quality connotation positively.

To bring this to a close, lean manufacturing and shaving costs out the value chain is important as the industry matures, but if we [as an industry] are to make any meaningful increase in our margins and increase profitability, it has to come from the demand side of the equation, whcih means we must obtain higher prices for the products and services we offer!

Profitability in a Maturing Marketplace

There is little doubt that the green industry has been characterized with unprecedented growth, innovation, and change over the last couple of decades. Yes, the fact that the green industry in the United States represents $148 billion in economic impacts and almost 2 million jobs nationally is impressive. The fact that nursery and floral production still represents one of the fast growing sectors in agriculture means profitability in the industry has been evidenced otherwise such growth would not have occurred. However, slowing growth in demand tighter margins (along with other aforementioned factors) point to a maturing market. Survival in the next decade will require a progressive mindset and perhaps a willingness to strengthen existing or develop new core competencies (which may incur greater risk).

While the crystal ball may be somewhat fuzzy in terms of the growth and nature of consumer demand, there is little doubt that innovativeness will continue to be a requisite skill in ensuring the survivability and profitability of green industry firms in the future. As the new competitive character of green industry maturity begins to hit full force, any of several strategic moves can strengthen a green industry firms’ competitive position including pruning the product line, improving value chain efficiency, trimming costs, accelerating marketing and sales promotion efforts, and acquiring struggling competitors.

For more on this subject, click here.

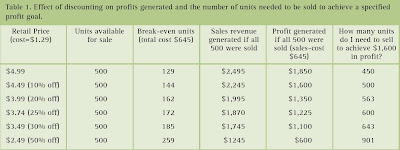

How can they sell it at that price?

Let’s face it. Business in the Green Industry is competitive and sometimes cut-throat. In recent years, I have had many growers ask me the question: What do I do when another grower is selling product in my market at a price that is below my break-even cost? While there is no perfect answer to this question, I have included several tried and true suggestions below.

- Sharpen your sales skills. For example, educate buyers regarding your unique selling proposition in terms of your quality, value, service, convenience, and selection relative to the competitor(s). Also emphasize the historic “win-win” relationship you have shared with the buyer – assuming you have one of course. Some examples might include: a) that you have been there when they needed you, b) that you did not gouge them with extraordinary price increases when availability of a certain product in the market was low, c) that the low prices obtained from the undercutting grower are simply not possible at the quality level you typically provide.

- Go and buy as much of the competitor’s product you can and use it as part of your own inventory – assuming it is of comparable quality or could be within a short period of time.

Match the price in the short run. A marginal pricing strategy (where selling price is greater than your variable costs but less than total costs) can be used in the short run, but remember that it is not sustainable in the long run. With this strategy, you are attempting to “wait out” the competition until theoretically they go out of business or can no longer afford to compete in your market. This is considered to be more reactive in nature, whereas the first two options are more proactive. You must emphasize to the buyer that this is a one-time phenomena; that you are only doing this because you value their business. - Consider the nature of the product they are selling in your market. If the product they are selling in competition to yours has become “commodicized” – that it has become a commodity item that many are starting to grow and carry – then you have the option to quit growing it, or grow a different size, form, cultivar, or variety. In other words, tweak the commodity so that it becomes a differentiated product.

- Examine your production system and the associated costs of production for that product. It may be that you are using a system that increases your relative costs of production. To do this, you may have to visit other growers, attend educational conferences and workshops, or participate in field tours.