“Happy economic times are all alike; unhappy times are unhappy in their own way.”

A recent article by Ram Charan in Fortune Magazine (2/18/08) reiterated many of the points made in my earlier posts about NOT cutting back too drastically during economic downturns; especially in terms of marketing programs. Here are the highlights:

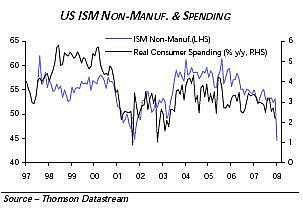

What makes the current economic downturn distinctively unhappy is the unprecedented confluence of three things. First, there was a Fed-induced housing bubble – too much cheap money for too long. Then there was the rampant use of exotic financial instruments, such as collateralized debt obligations, to disperse risk among people who didn’t understand it. Finally, the rating agencies failed to catch the poor quality of a great deal of highly rated debt. With lots of momentum – and faulty brakes – the financial system hit the skids.

Whether this turns into an official recession (two straight negative quarters) is immaterial: What matters is how their business is affected, segment by segment. But certain principles apply broadly:

Keep building. When the top line looks shaky and the bottom line worse, the temptation is to go after discretionary spending. Fine – but do not consider product development, innovation, and brand building optional. Sacrificing your future for a slightly more comfortable present is not worth it. If you keep building, you can come back strong.

Another area to build on is personnel. It may seem counter-intuitive to pay bonuses when profits are falling, but sometimes it’s the right thing to do, particularly if a specific unit is creaming the competition. Rewarding excellence – through new challenges, public recognition, and, yes, money – in bad times as well as good builds loyalty.

Communicate intensively. Get information from where the customer action is, and get it to the operating people – fast. Companies should do so routinely, of course. But they don’t. It’s counterintuitive but true that when the economy slows down, the pace of decision-making has to speed up, because you can’t put off the tough choices anymore. The companies that are readiest to act on solid information are primed to shoot ahead of the business cycle.

Communication needs to happen among teams in the company. In the hot summer of 1787, the Founding Fathers locked themselves into a room and wrote the entire Constitution in a matter of weeks. That’s not a bad model for a company under pressure. Fill a room with people from operations, service, marketing, and sales, and require them to hash out their expectations for the next eight quarters or so – what if demand goes down? if prices of key inputs go up? – and then to devise coordinated plans to meet them.

And keep it up, repeating the exercise every month. When the facts change, to paraphrase Keynes, so must your strategy. Research has shown that when people have thought through their reactions to high-stress scenarios – such as a disaster or being a victim

of a crime – they are much more likely to survive it. Ditto for business.Evaluate your customers. In good times, companies manage the P&L; in bad times, cash and receivables matter more. Therefore, you need to identify your higher-risk, cash-poor customers. You could decide to simply not supply them anymore – that’s harsh but sometimes necessary.

Alternatively, and this helps build good relations, work out a way to keep going – for example, by helping finance purchases or supplying smaller quantities. The point is, a downturn is a very good time to do a quality check on your customers.

Just say no to across-the-board cuts. By all means cut costs if it makes sense to do so, but make sure there is purpose in how you do it. It may be useful to clean out the metaphorical attic – for example, by pruning your product line. The key: If you have to cut costs, don’t try to be fair about it. As I have said before, the world does not inflict pain evenly, and you have to deal with that reality.

Being on the downside of the business cycle is not much fun. That said, a slump can also be an opportunity if you use the sense of urgency to improve strategy, management, and discipline. In that sense, happy and unhappy times are alike: The companies that take charge and outcompete will win.