Though the holiday season is far from over, retailers across the country are breathing a collective sigh of relief after shoppers headed to stores and websites in droves over the weekend. According to the National Retail Federation’s 2008 Black Friday Weekend survey, conducted by BIGresearch, more than 172 million shoppers visited stores and websites over Black Friday weekend, up from 147 million shoppers last year. Shoppers spent an average of $372.57 this weekend*, up 7.2 percent over last year’s $347.55. Total spending reached an estimated $41.0 billion. “Holiday sales are not expected to continue at this brisk pace, but it is encouraging that Americans seem excited to go shopping again.” said NRF President and CEO Tracy Mullin.

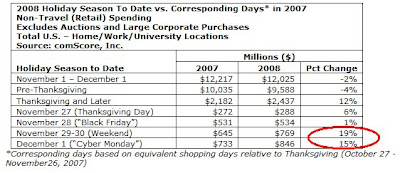

It also looks like more people than ever spent the first workday of the holiday season doing something other than work on their computers. Online shoppers spent $846 million in the U.S. on ‘Cyber Monday,’ according to new comScore Networks data. That was a 15% increase over the same day last year (see chart above).

It also looks like more people than ever spent the first workday of the holiday season doing something other than work on their computers. Online shoppers spent $846 million in the U.S. on ‘Cyber Monday,’ according to new comScore Networks data. That was a 15% increase over the same day last year (see chart above).