A recent article in the Houston Chronicle recently highlighted the plight of the Columbian flower industry in the wake of the devaluation of the dollar in the U.S. Since 6 of every 10 flowers sold in the U.S. hails from Columbia, Columbian flower profitability is extremely sensitive to demand impacts caused by the economic slowdown stateside. As a result, the income (in pesos) of Columbian growers has plummeted in spite of their worldwide exports increasing to $1 billion last year. About a dozen large Columbian flower farms have closed in the past 3 years, eliminating about 15,000 jobs. For the complete story, click here.

H-2A "patch" proposed

The H-2A program is the temporary agricultural worker program for growers and producers in most agricultural industries. In a joint media briefing by Secretary of Homeland Security Michael Chertoff, Secretary of Labor Elaine Chao, and Deputy Secretary of Agriculture Chuck Conner, two separate sets of regulations have been proposed for public comment: the Department of Labor’s proposals to “modernize” the program and Homeland Security proposals on the hiring process itself.

The current H-2A program is unpopular with employers — only about two percent of agricultural workers come in under the H-2A program. Growers typically do not fully utilize the program because it is expensive, litigious and [quite frankly] bureaucratic. In the face of increased enforcement and a decreasing labor force, the inability to secure sufficient workers means that crops are rotting in the field in many industries and there is a less stable supply of workers available for growers in the Green Industry. One of the many problems with the current system is that the Department of Labor consistently fails to meet its own deadlines required by law, therefore farmers cannot depend on the program’s promise to provide the correct number of workers at the correct time.

The new regulations being proposed would provide some relief, but in other areas raise serious concerns. On one hand the new rules include changing the process employers must go through to apply for workers, making it less burdensome. However, the proposal also would allow the Labor Department to start random audits of H-2A employers, and increase the fines from $1,000 to $15,000 for employers who have displaced American workers by hiring foreign ones. Other fines would increase for violating regulations from $1,000 to $5,000. In addition, under the proposed changes, wages would be based on “skill levels” and the wage formulas are changed.

Obviously, the proposal is long, complex and needs careful review, but it probably represents a good first step. However, since H-2A reform alone cannot address the breadth and depth of the agricultural labor crisis, there is still a desperate need for overarching immigration reform that will will provide the industry with a workable guestworker program. If Congress fails to act, employers will undoubtedly face a plethora of state and local laws, increased enforcement, and a new “No-Match” rule, which is expected shortly.

Floriculture industry statistics available

The latest statistics regarding floriculture industry trends, sales and production levels are now available in “The Changing Floriculture Industry: Fourth Edition” Inside, you’ll find more than sixty pages filled with maps, charts and tables. It has twice the data of the previous edition and includes a new chapter entitled “The Floral Consumer” drawing on five years of industry-sponsored consumer research. The report is produced by SAF’S Business & Economic Trends Committee and focuses on floriculture production, importing, retailing and wholesaling. To order this report or to find our more information, click here.

Which crystal ball to believe?

Needless to say, I have been receiving a lot of questions at various meetings on the economic forecast for this year and the prognosis for the Green Industry. I always receive curious looks when I start off saying “It depends on who you’re listening to!” Perhaps the following may help to explain. The Federal Reserve Bank of Philadelphia just released its latest survey of professional forecasters and panelists were divided on when the effects of a government fiscal stimulus package would be apparent and how large the effects would be. Thirteen economists reported an effect beginning in the second quarter and 19 think the effect will begin in the third quarter. Two estimated that the effect won’t begin until the fourth quarter, and the remainder didn’t provide answers. The majority, however, expect the stimulus package to have a welcome but moderate effect on the economy. Almost a quarter said tax rebates would have a significant effect on consumer spending, while just 7% expected investment tax credits to have a major impact on business spending. Some 22% said tax rebates would have an insignificant or no effect, while 38% said investment tax credits would have an insignificant or no effect. Overall, economists in the Philadelphia Fed survey raised expectations for GDP contraction this year, but on average still expect the economy to grow, albeit at a sluggish pace. See what I mean!

An Economic Justification to Raising Your Prices

In the January issue of GrowerTalks, Chris Beytes provided us with some excellent case studies of firms that have recently raised their prices (great job Chris!). I think it merits repeating that the only way in which this makes sense economically is if the company successfully differentiates itself in the mind of the customer in terms of the types of products or services offered and the segment(s) of customers that are being targeted. It is a well-proven fact that customers use five different attributes in making a decision about what products/services to buy and from whom to buy them from – quality, value, service, convenience, and selection.

We economists characterize demand by a concept called the price elasticity of demand which measures the nature and degree of the relationship between changes in the quantity demanded of a good/service and changes in its price. An important relationship to understand is the one between elasticity and total revenue. The demand for a good/service is considered relatively inelastic when the quantity demanded does not change much with the price change. So when the price is raised, the total revenue of the firm increases, and vice versa. What this effectively means is that green industry firms can actually raise their price, and though they might sell fewer units of the product they are selling or the service they are offering, total revenue for the firm still goes up. So, the obvious question is this…how does one go about making their local demand more inelastic? The answer…by making the firm unique and different somehow in terms of quality, value, service, convenience, and selection! That’s why your marketing efforts are so important. They are the key to successful differentiation.

In summary, if your company is successful in differentiating itself from competitors, you are essentially making your firm-level demand more inelastic within your respective trade area and you can subsequently raise your prices and [even though you may sell fewer units] total firm revenue will still increase.

Now I can already hear the objections: “If I raise my price, my customers are going to defect and buy from my competitors.” Let me provide my own testimonial regarding this common objection to raising price. Over the last few years, all (100%) of the green industry firms that I have convinced [after much prompting and counseling] to actually try this have experienced an increase in total firm revenue. Not many, not most…ALL. Interestingly, some even found that per-unit sales actually increased when they increased their prices, which tells me they were pricing their products way too low to begin with. Low prices tend to result in a low quality perception in the mind of the customer and when you raise your prices, sometimes you can influence the price-quality connotation positively.

To bring this to a close, lean manufacturing and shaving costs out the value chain is important as the industry matures, but if we [as an industry] are to make any meaningful increase in our margins and increase profitability, it has to come from the demand side of the equation, whcih means we must obtain higher prices for the products and services we offer!

Amazing! Congressional stimulus package set

Acting just three weeks after President Bush first proposed a $150 billion economic stimulus plan, the Senate added rebates for 20 million seniors and 250,000 disabled veterans to a package passed by the House last week. The new measure, adopted by the House Thursday night, is estimated to cost $168 billion over two years.

The measure goes to Bush for his signature, which White House deputy press secretary Tony Fratto said will come next week. Treasury Secretary Henry Paulson said the Internal Revenue Service will get to work immediately, but it will take two to four months for the rebate checks to arrive.

Most single taxpayers will get $600 and couples $1,200, plus $300 for each child under 17. Anyone with at least $3,000 in earned income last year will get $300, as will seniors on Social Security, even if they paid no income taxes. The rebates phase out beginning at $75,000 in adjusted gross income for individuals, $150,000 for couples.

The big question now is how the Federal Reserve will react. Adjusting monetary policy in the wake of fiscal policy interventions is always a tricky thing. Regardless, I still maintain that when folks actually receive rebate checks will influence how much is actually spent on lawn and garden products and services. More on this in a future post.

Back to the drawing board…for now.

Senate Republicans blocked a move by Democrats on Wednesday (1/06/08) to add more than $40 billion in checks for the elderly, disabled veterans and the unemployed to a bill to stimulate the economy. The 58-41 vote fell just short of the 60 required to break a GOP filibuster and bring the Senate version of the stimulus bill closer to a final vote. The Senate measure was backed by Democrats and a handful of Republicans but was strongly opposed by GOP leaders and President Bush, who objected to the costly add-ons. The vote left the $205 billion Senate stimulus bill in limbo and capped days of partisan infighting and procedural jockeying over the measure. One news article reporting on the vote says “The dispute has slowed down the stimulus measure, but there’s no indication that it will delay rebate checks, which are expected to begin arriving in May.” Yeah, right.

One step closer to recession???

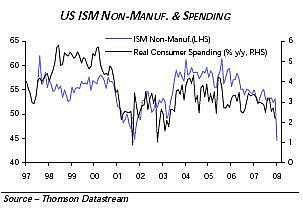

Recession worries surged, slamming financial markets, amid signs that service businesses may be stumbling. A key barometer of the strength of the service sector dropped to its lowest level since October 2001 and suggested those businesses are now contracting. ISM’s Non-Manufacturing Business Activity Index registered 41.9% in January, indicating a significant contraction in business activity in January from the seasonally adjusted 54.4% registered in December. This is the first contraction in the non-manufacturing sector since March 2003, when the index registered 46.3%, and the lowest Business Activity Index since registering 40% in October 2001 (one month after 9/11). The next piece of major economic data comes in a week with the retail sales report for January. Reports from retailers already offer cause for concern. Capital Economics today offers another sign of caution, and it goes back to the surprise drop in the ISM’s nonmanufacturing index that shook markets yesterday. The firm tracks the ISM’s service-sector index against real consumer spending and finds they are correlated, meaning that next weeks retail sales report should prove interesting! Even so, most pundits still only put the chance of the U.S. entering recession at 42%. All for now…time to polish the crystal ball.

Effect of Stimulus on Green Industry

To combat the recent slowing of the U.S. economy, Congress is currently working to develop a fiscal-oriented stimulus package. The House has approved its version and the Senate is currently attempting to do the same.

The House plan would send rebates of $600-$1,200 to about 111 million Americans who receive paychecks of $3,000 or more, plus an additional $300 per child, with less available to individuals with income in excess of $75,000 and couples making more than $150,000. The Senate version has checks of $500-$1,000 for a broader group that includes 20 million seniors and 250,000 disabled veterans, and taxpayers making up to $150,000 — or $300,000 for individuals. The Senate package also includes a $14.5 billion unemployment extension for those whose benefits have run out, $1 billion in heating aid for the poor — a program that enjoys broad bipartisan support — and a tax break that allows businesses suffering losses to reclaim previously paid taxes. It includes $10 billion in mortgage bonds to help homeowners refinance their loans and several tax breaks for renewable energy. – Houston Chronicle, 2/06/08.

Recent debate over the ability of the $148-$157 billion stimulus package being considered by Congress to actually bolster the domestic economy begs the obvious question: What will be the potential impact of said stimulus on the economy and how much of it will translate into sales of green industry products and services? Not an easy question to address, but perhaps we can glean from the experience of the 2001 stimulus package to draw some conclusions.

In the summer of 2001, the government mailed a total of $38 billion in $300/$600 one-time rebate checks to two-thirds of U.S. households. A 2004 study by U.S. Labor Dept. economists, Princeton University, and the Univ. of Pennsylvania estimated that the rebates increased aggregate consumption expenditures by about 0.8% in the 3rd quarter of 2001 and 0.6% in the 4th quarter. Two University of Michigan economists found that the tax incentive added 100-200,000 jobs and increased GDP by a scant 0.1 to 0.2%. – WSJ, 1/19-20/08, p.A6. One other [debatable] point is that University of Michigan economists estimated that only 20 percent of the 2001 stimulus rebate check injection was actually spent on consumer goods. The rest was used to either pay down debt or put into savings. — Austin American Statesman, 1/19/08, p.A17.

Interestingly, this time around, according to Jason Furman at the Brookings Institute, as many as 57 million households (37% of total households) would receive no benefit under the plan as currently structured.

Of the households that may indeed receive rebate checks this year, the timing of their receipt may have an influence on whether any expenditures are made on lawn and garden products and services. If checks are received by mid-to-late May or early June, there may be opportunity for such spending to occur in lawn and garden retail outlets. Otherwise, the vast majority of purchases may end up on ‘unnecessary plastic objects’ from offshore manufacturers (e.g. China) thereby being a primary stimulus for economies other than ours!

Another point to consider is that rebate checks (by themselves) are not likely to spur any lifestyle changes or fund any major asset purchases. This is in keeping with the late economist Milton Friedman’s “permanent income hypothesis” which said that people do not change their spending habits based on small blips in their income. In short, you can’t fool people into thinking they are richer than they really are.

Recession Resistance: Real or Wishful Thinking?

During a presentation today (click here to view) at the 2008 Tennessee Nursery and Landscape Association Winter Education conference, I emphasized what I feel is the key business strategy that growers, landscape service firms, and retailers must embrace in order to survive the maturity stage of the green industry life cycle – differentiation – that is, specializing by product, services offered, customer type, or geographic area. Of course, in setting the stage for this differentiation discussion, current industry trends had to be reviewed to prove the initial supposition that the green industry is indeed maturing. Trends in grower-level nursery and greenhouse sales, DIY lawn and garden activities, and the recent growth in lawn & landscape services were presented, with several anecdotal observations including the industry’s historical recession resistance, correlation to housing starts, and factors affecting the cost-price squeeze being felt by all industry participants. No sooner had I packed away my laptop away and turned my blackberry back on did I receive an email from my esteemed colleague, Dr. Marvin Miller of Ball Horticulture, sharing a recent pontificating regarding the very concept of recession resistance that I had just discussed. Marvin writes:

“You might hear comments suggesting our industry has always been recession proof, but that is a piece of “ancient history.” Historically, when the industry was dominated by cut flowers and many of these were used for funerals and other traditional occasions, the industry may have been somewhat resilient even in times of economic stress. Over the last 30 years, our society’s use of funeral flowers has dramatically declined, but more importantly, the majority of purchases of our industry’s products are now focused in less tradition-bound occasions. Indeed, during the late-1980s recession, our industry was affected, as hotel after hotel removed foliage plants from their atria and lobbies in cost-cutting initiatives; it was the weekly maintenance of these plants that was more of concern than the cost of the plants per se. Similarly, supermarket sales of floricultural products slowed during that recession, as consumers found a way to cut back on their grocery bills by reducing self-consumption.

Today, the bedding/garden category so dominates domestic production and accounts for a major share of consumption. If a recession does come, we may be writing a different story altogether on its effect on industry sales. Some would argue that we will be affected as consumers find another way to save money. Others might argue that consumers will save on vacations and other travel costs and instead spend that time at home, perhaps, spending even more effort on their own garden. I know if I owned a garden center right now, I would certainly be preparing POP materials that expressed the sentiment that one should “plant a little vacation paradise in your own backyard.” Certainly, one could argue that a good share of our industry’s sales go to folks that will feel proportionately less pain during a recession; in this scenario, independent garden centers may fare much better than chain stores focusing on consumers with more modest incomes. Whatever the outcome, the next few months will be interesting.”

I couldn’t agree more Marvin. In a follow-up phone conversation later in the day, we agreed that this phenomenon of recession resistance can be validated quite readily anecdotally, but proving it with actual data is a little trickier. Personally, I like to point to the most recent recessionary period (2001) for comparative purposes due to its similarity to the current economic conditions in which we find ourselves (see earlier posts). In the 2001-02 period, grower-level sales continued to expand, as well as DIY lawn & garden activities and landscape services demanded. It wasn’t until after the recession was over that DIY lawn & garden retail sales started declining. This was perhaps more a result of Boomers maturing and demanding more DSIFM (do-some-of-it-for-me) services than any post-recessionary effects. A perfect proof of our theorem? Maybe. I think I’ll reserve that conclusion until at least the 1st quarter of 2009!