A little economic humor for the holidays…

Next webinar up: The Economic Outlook for the Green Industry in 2013

In this webinar, Dr. Charlie Hall will provide projections for the economy in 2013 and how the economy will impact the green industry next year. Special post-election commentary will forecast what effects might be expected given the so-called fiscal cliff that is looming.

In this webinar, Dr. Charlie Hall will provide projections for the economy in 2013 and how the economy will impact the green industry next year. Special post-election commentary will forecast what effects might be expected given the so-called fiscal cliff that is looming.

Title: “The Economic Outlook for the Green Industry in 2012”

Date: Thursday, November 15, 2012

Time: 11:00 AM – 11:45 AM CST

Register now by clicking the link below:

https://www1.gotomeeting.com/register/607656176

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows(R) 7, Vista, XP or 2003 Server

Mac(R)-based attendees

Required: Mac OS(R) X 10.5 or newer

Mobile attendees

Required: iPhone(R), iPad(R), Android(TM) phone or Android tablet

2010 Wholesale Value of Floriculture Crops Increased 3 Percent

The 2010 wholesale value of floriculture crops is up 3 percent from the revised 2009 valuation. The total crop value at wholesale for the 15-State program for all growers with $10,000 or more in sales is estimated at $4.13 billion for 2010, compared with $4.00 billion for 2009. California continues to be the leading State with crops valued at $1.01 billion, up 8 percent from the 2009 value. Florida, the next largest producer is down 1 percent from the prior year to $810 million in wholesale value. These two States account for 44 percent of the 15-State total value. For 2010, the top 5 States are California, Florida, Michigan, Texas, and North Carolina, which account for $2.75 billion, or 66 percent, of the 15-State total value.

The number of producers for 2010, at 6,126, is down 7 percent in the 15 States compared with the revised 2009 count of 6,561. The number of producers with sales of $100,000 or more dropped 7 percent to 2,706 for 2010 from 2,918 in 2009. In the 15-State program, total covered area for floriculture crop production was 725 million square feet. However, these data are not comparable with the 2009 revised area of 807 million square feet because the 2009 data was collected in conjunction with the Census of Horticultural Specialties and included area used for production of nursery crops as well as floriculture crops.

For the rest of the report, click here.

Which countries match the GDP and population of America’s states?

The Economist’s online edition has an interactive map with the actual numbers, as well as an option to look at population rather than GDP. Talk about a perspective changer!

Value of Home Gardening

Findings from the National Gardening Association’s (NGA) new survey, The Impact of Home and Community Gardening in America, confirm that food gardening in the U.S. is on the rise. Seven million more households plan to grow their own fruits, vegetables, herbs, or berries in 2009 than in 2008 — a 19 percent increase in participation. This anticipated increase is nearly double the 10 percent growth in vegetable gardening from 2007 to 2008 and reflects the number of new food gardeners emerging this year.

More Americans are recognizing the benefits of growing their own produce, including improved quality, taste, and cost savings. In 2008, gardeners spent a total of $2.5 billion to purchase seeds, plants, fertilizer, tools, and other gardening supplies to grow their own food. According to NGA estimates, on average a well-maintained food garden yields a $500 return when considering a typical gardener’s investment and the market price of produce.

Gas prices actually do influence driving behavior

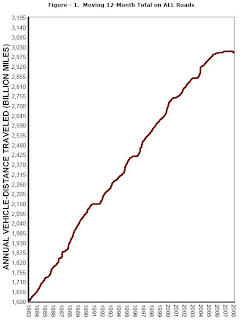

The chart below shows the annual vehicle traffic volume, measured in billions of miles traveled in the U.S., on a moving 12-month basis through February 2008 from the Federal Highway Administration. The flat trend in traffic volume over the last year or more, along with the declines in each of the last four months through February 2008, appears to be the most significant adjustment to traffic volume in any comparable period during the last 25 years. High gas prices appear to be having an effect on driving habits.

Other behavior changes:

More bicycles are being sold.

More folks are taking mass transit.

More small cars are being sold.

Gas tax holiday is NOT the answer

In case you’re wondering where I stand on the proposed proposed gasoline tax holiday, it would save the average individual motorist a grand total of $28 this summer, but would result in $9 billion in lost tax revenues which would be mostly targeted for infrastructure needs. This is a politically motivated move, not a well-thought-out economic decision. Enough said.

Data source: American Association of State Highway and Transportation Officials

Don't throw in the towel just yet

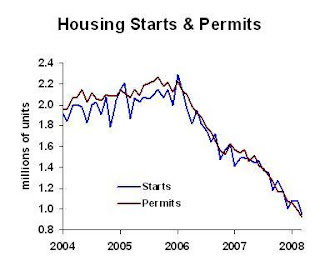

Media stories abound with tales of economic hardship. These for the most part have elements of truth, but keep in mind when you read the news that at any time it’s possible to find people in hardship. To know whether you are seeing a trend of just an unfortunate blip, you have to look at the data. Today’s data is: (1) bad but expected, (2) bad but not as bad as expected, and (3) so-so. Let’s start with bad but expected: New housing construction continues to fade. Bad news, but a necessary correction with significant excess supply of housing. Now for the not as bad as expected:

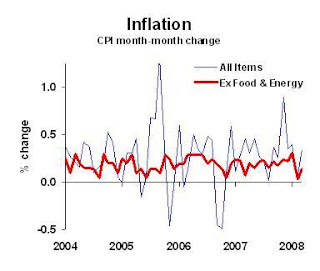

New housing construction continues to fade. Bad news, but a necessary correction with significant excess supply of housing. Now for the not as bad as expected: The inflation rate outside of food and energy is not as bad as most expected. There were also major concerns that we would start seeing inflation rising not just in food and energy, but generally across the economy. This isn’t happening right now.

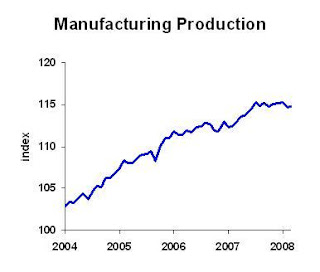

The inflation rate outside of food and energy is not as bad as most expected. There were also major concerns that we would start seeing inflation rising not just in food and energy, but generally across the economy. This isn’t happening right now. Manufacturing production is basically unchanged in recent months. That’s not good, not bad, but consider this: Any news that isn’t bad these days, is good news.

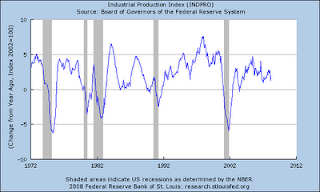

Manufacturing production is basically unchanged in recent months. That’s not good, not bad, but consider this: Any news that isn’t bad these days, is good news. One last data observation — someone obviously forgot to tell the IPI data that we’re in recession (click graph above for larger image).

One last data observation — someone obviously forgot to tell the IPI data that we’re in recession (click graph above for larger image).

Bottom line: The economy is NOT collapsing, despite all the doom and gloom in the press. The economy is certainly not booming, and some folks are in distress [regionally], but overall things are not so bad. Yesterday about four million people in the United States went to McDonald’s to eat. That wasn’t news, because most days there are about four million people going to McDonald’s. It’s not an economic boom, but neither is it a bust.

My discussions with growers, landscapers, and retailers continues to reinforce the importance of differentiation. Those who are providing a uniquely definable value proposition say they are holding their own and some even reporting a profitable spring thus far. Those who aren’t, … aren’t. And by the way, the folks who are doing good business so far are NOT discounting prices. How do I know this? I asked them. Anecdotal evidence, yes, but telling nonetheless.

Business planning implications: Don’t hunker down too much. In fact, it’s time to do your economic contingency planning for an upturn in the economy.

Will the real trade issues please stand up?

President Bush said Monday that a trade agreement with Colombia is “dead” unless House Democrats agree to hold a vote on the pact, effectively admitting defeat on a White House priority. The standoff over Colombia began last week, after Bush submitted the trade agreement to Congress and urged lawmakers to approve it within the normal deadline of 90 legislative days. The Democrat-controlled House then voted to postpone the decision indefinitely, saying the pact does not provide enough protections for workers. As projected, this has spiraled into a political issue rather than one made on economic intuition.

On economic grounds, there’s no reason to reject the agreement. Colombia’s exports already enter the U.S. market duty-free under the 1991 Andean Trade Preference Act. Meanwhile, many U.S. exports to Colombia face stiff tariffs — up to 35 percent on autos, 15 percent on tractors and 10 percent on computers — most of which would ultimately go to zero under the agreement.

Yet, it’s politically convenient to oppose the trade agreement because the popular imagery is that trade destroys U.S. jobs. The loss of almost 4 million U.S. manufacturing jobs since 1998 seems easy to explain by cheap imports or the flight of plants to Mexico, China and other poorer countries.

Nothing could be further from the truth. Although this has occurred, job losses also stem from greater efficiency (fewer workers producing more goods) and slumping domestic demand (for communications equipment and computers after the dot-com bust and for housing materials and vehicles now). Nor has falling factory employment crippled overall U.S. job creation.

The fact of the matter is that trade has become a lightning rod for a myriad of grievances (job insecurity, wage inequality, eroding fringe benefits). But even if trade caused all the factory job loss, its impact is shifting. The dollar’s dramatic depreciation (down an inflation-adjusted 20 percent since early 2003) has enhanced the competitiveness of U.S. exports. Export growth now represents a major source of job creation and economic expansion.

It is no longer necessary to rely on elegant theories of comparative advantage, more consumer choice or greater competition to favor open trade. Jobs and economic growth will suffice. Indeed, without export-led growth, the economy may face a sluggish future.

Even after the current economic slowdown ends, the outlook is worrisome. Consumers are heavily indebted. Housing will recover and reach previous highs, but probably not for several years. Government spending is constrained by growth in the rest of the economy, unless Congress sharply raises taxes or deficits. Exports and related investments are our best hopes. Let’s hope we don’t shoot our other foot by constraining part of the current economic solution.

Economic Damages from Drought in Southeast

So far, 35,000 out of the 79,000 green-industry employees in Georgia have lost their jobs, with another 30,000 in jeopardy of losing their jobs due to the historic drought. “The only ones left are pretty much the owners and their families,” said Sherry Loudermilk, exec. dir. of Ga. Green Industry Assoc. The industry in Georgia lost $3.15 billion in 2007 alone. Loudermilk has some suggestions about how the national green industry can help. GMPRO editor David Kuack also reports on how the Southeast drought is putting a big hurt on horticulture.