A new report from the NBER by Charles W. Calomiris, Stanley D. Longhofer, and William Miles shows that “on average, a single dollar increase in housing wealth raises consumption by between five and eight cents.”

A new report from the NBER by Charles W. Calomiris, Stanley D. Longhofer, and William Miles shows that “on average, a single dollar increase in housing wealth raises consumption by between five and eight cents.”

If the value of a homeowner’s house rises by one dollar, how much will that homeowner increase spending on consumption? In The Housing Wealth Effect: The Crucial Roles of Demographics, Wealth Distribution, and Wealth Shares (NBER Working Paper No. 17740), authors Charles Calomiris, Stanley Longhofer, and William Miles determine that the impact of housing wealth on consumer spending depends crucially on the age and wealth distribution within states, as well as on the share of housing wealth relative to total wealth. In particular, they find that young people, who are more likely to be credit-constrained, and older homeowners, who are likely to be “trading down” on their housing stock, experience the largest housing wealth effects. Housing wealth effects also are higher in years when housing wealth shares represent a larger portion of overall wealth an d in years with higher poverty rates. Thus, there tends to be huge variation over time and across states in the size of housing wealth effects.

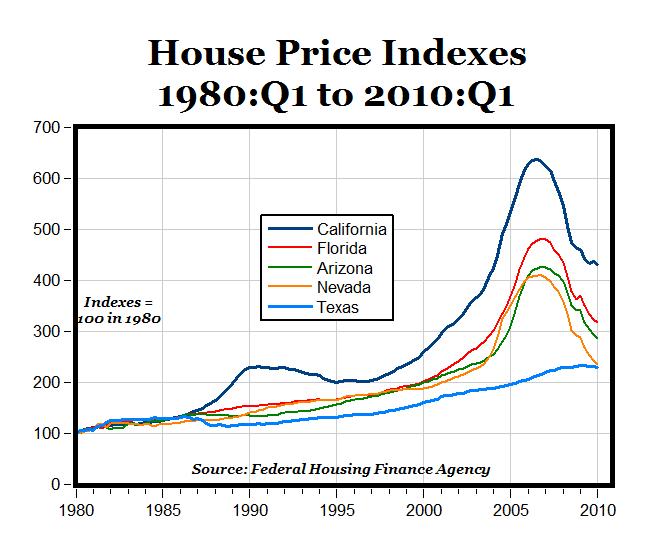

For this study, the researchers constructed a new annual dataset for each of the U.S. states for the period 1981-2009, taking into account the relative amount of state-level housing and securities wealth in any given year. They also considered differences in age distribution and poverty rates, both across states and over time, because housing wealth effects tend to be larger in state-years with high proportions of young and old people, and in state-years with higher poverty rates. In addition, they estimated holdings of corporate stock in each state by calculating aggregate U.S. stock wealth and multiplying by each state’s share of aggregate mutual fund holdings.

Calomiris, Longhofer, and Miles find that consumption responds positively to innovations in both housing wealth and securities wealth, but that housing wealth effects are significantly larger than stock wealth effects. They estimate that on average, a single dollar increase in housing wealth raises consumption by between five and eight cents. In contrast, the same dollar increase in the value of securities wealth raises consumption by less than two cents. Nonetheless, there is substantial variation across states and over time in both of these consumption responses to wealth changes, which are related to the age, poverty, and wealth characteristics of various states at particular points in time.