New and Existing Home Sales Drop in May, After Expiration of Homebuyers’ Tax Credit.

New home sales fell to a record low in May, with sales of new single-family houses dropping 32.7 percent from April to a seasonally adjusted annual rate of 300,000, the lowest annual rate of sales since the Commerce Department started tracking the data in 1963 (read more here; see chart).

Excluding Transportation, Durable Goods Orders Rise.

Durable goods orders, excluding transportation, rose by 0.9 percent in May to $145.1 billion, the U.S. Census Bureau reported. Year-over-year, durable goods, excluding transportation, increased 17.6 percent. Transportation orders fell 6.9 percent to $46.9 billion, driven by a $3.0 billion decline (29.6 percent) in nondefense aircraft and parts (read more here).

First Quarter GDP Growth Revised Downward.

The economy grew more slowly in the first quarter of 2010 than previously estimated, according to the final real GDP estimate from the Bureau of Economic Analysis. GDP growth was revised to 2.7 percent, down from the second estimate of 3.0 percent, primarily reflecting a downward revision in personal consumption expenditures and net exports (read more here).

Personal Income Increases

Personal income in May 2010 increased 0.4% from April 2010.Real personal consumption expenditures (PCE) increased 0.3% and real disposable personal income (DPI) rose 0.5%.The personal savings rate as a percentage of DPI was 4.0% in May.

Consumer Confidence Rises

Consumer sentiment rose in June to its highest since January 2008 while reports of job losses were down sharply from a year ago, a survey showed on Friday. A gauge of current economic conditions also rose to its highest since January 2008, according to the Thomson Reuters/University of Michigan’s Surveys of Consumers. NEW YORK (Reuters)

Source:

Source:

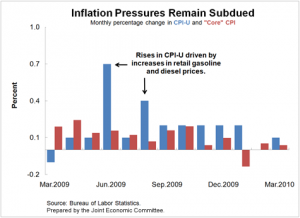

Inflation Remains Subdued. The Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U), a key measure of inflation, rose by 0.1 percent in March. Core CPI-U, which excludes the food and energy categories and is a less volatile measure of inflation, remained unchanged in March relative to February. This follows the general pattern of low inflation that has persisted since the start of the recession, and projections by the Administration, the Federal Reserve, and the Congressional Budget Office all suggest that inflation will remain low at least through 2012. The low inflation reading should allay concerns that the economy is in danger of experiencing high levels of inflation that may cause the Fed to raise the federal funds rate sooner than otherwise expected.

Inflation Remains Subdued. The Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U), a key measure of inflation, rose by 0.1 percent in March. Core CPI-U, which excludes the food and energy categories and is a less volatile measure of inflation, remained unchanged in March relative to February. This follows the general pattern of low inflation that has persisted since the start of the recession, and projections by the Administration, the Federal Reserve, and the Congressional Budget Office all suggest that inflation will remain low at least through 2012. The low inflation reading should allay concerns that the economy is in danger of experiencing high levels of inflation that may cause the Fed to raise the federal funds rate sooner than otherwise expected. Another graph from EconompicData shows the strong building material and garden supplies category:

Another graph from EconompicData shows the strong building material and garden supplies category: