The U.S. Dollar index for major currencies reached its highest level this year, and is at the highest level since December 21, 2007 (see chart below). Oil fell yesterday by almost $5 per barrel in the spot market to $112.43 (brent spot) and $115.20 (WTI) and below $115 in the futures market. The stock market rose by +300 points.

If you're a service provider, then take note…

FYI — Dow AgroSciences is sponsoring a successful landscape business owner/entrepreneur, Marty Grunder, who will be hosting a business building seminar on August 27th in Dallas and Aug. 28th in Houston. This is an excellent opportunity for professional lawn care/landscape, golf course managers, pest control, and other green industry professionals to come and learn about some of the practical things Marty has done over the years to start with a $25 lawn mower in high school and grow his landscape company to over $4 Million as of last year!

Marty is a friend of mine; I have heard him speak on many occasions and I can vouch for the fact that he knows his stuff, has a big heart, and sincerely wants to share his success secrets. I promise you — you will NOT come away from his seminar disappointed, but you will come away with a much bigger to-do list than you have now!

Go to Register at www.BusinessIdeasToWin.com to register today!

Yes, I'm still here…

Given my perhaps-noticeable absence from pontificating frequently over the blogging biosphere this past week, you may have been wondering where in the world I was. I was in Gunnison, Colorado with my Dad catching up on some overdue water quality sampling, otherwise known as fly fishing (see photo below to see for yourself). Now that I’m back I am working on a MAJOR grant that will be submitted to the USDA as part of the Specialty Crops Research Initiative by August 14.

It was ironic, however, when I was checking my email upon my return that my friend Richard Scruggs who is Director of the Center for New Ventures and Entrepreneurship at TAMU, had an article in his latest newsletter that examined the parallels between fly fishing and business management. Click here if you’re interested in his comments.

Gas falls below $3.50 in Kansas

Dorothy is probably happy since gas prices fell below $3.50 in Topeka today. In my May 31 post, I referred to the EIA’s (Energy Information Agency) projection that gas prices could fall below $3.50 by the end of the year. Friends scoffed at the notion. Hmmm… Now to see what impact the backed-up traffic jam on the Mississippi River is going to have.

Coping with a down economy

As promised, here are a few strategies to consider for coping with a down economy. Some of these steps are radical, while others are a more milder form of defense. Implement them according to the conditions you experience in your market area.

- Conserve your cash. Don’t spend a dime on anything that isn’t absolutely necessary to your operation. Examine every personal expense you have to find alternatives to any spending patterns.

- Refinance anything and everything you can. Stretch out the payments because getting cash later on will be difficult as more people will apply for loans and banks will become very picky.

- Work out a worst-case scenario cash flow projection that projects your company having a decrease in sales. As part of this, determine what expenses will be unavoidable. Look through your cash disbursements. Pre-plan a less expensive alternative to any expense category that you can.

- Know your costs well because poor pricing can put you out of business faster. Assume that cost-side pressures caused by a recession will last about two years after a recession is over.

- Beef up your advertising/marketing. Everyone else is cutting back. Now is the time to gain “mind share.”

- Slowdowns mean layoffs. Therefore, new hires become available and are sometimes available at a lower rate of pay than your current rate. Take advantage of that fact.

- If part of your fleet is going to be idle for some time, try to store unused vehicles and get a reduced rate of insurance due to non-use.

- Selling off assets during a recession is difficult. Nevertheless, selling off unused equipment reduces insurance and registration costs and property taxes. Convert anything you don’t need into cash well ahead of any signals that your area will be hard hit.

- Apply for credit long before you need it. You may have to “borrow” your future, and banks will raise interest rates on high-risk loans as conditions worsen.

- Look deeper in your own markets. Can you offer your current customer base a more diversified line of products and/or services?

- Review your business insurance to make sure your premiums have been adjusted for the depreciated value of your vehicles and equipment.

- Take a look at your estimated tax payments made to the IRS. Decreased earnings call for decreased estimated tax payments.

Cash is “king” during economic slowdowns no matter how mild or severe. Expect your customers to also feel the effect, which means they will pay you at a much slower rate than during the good times. That’s precisely the reason that you’ll need additional working capital to finance your receivables if nothing else.

Run a cash flow working capital projection using 60 days, 90 days, 120 days and even up to six months to be paid from some of your customers. How much cash do you need to survive? Find the answer to that question. Prepare and save for that eventuality and you’ll be ready for a downturn.

These are the good old days…

Interesting commentary from Jeff Jacoby in yesterday’s Boston Globe (click here). Goes back to the adage of whether you consider the glass half full or empty, or just another thing to wash!

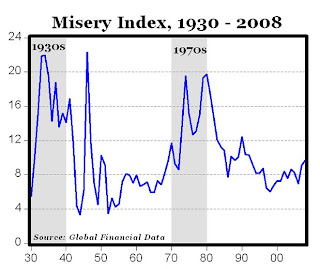

There are a lot of comparisons in the media of today’s economic conditions to the inflationary 1970s and even the Great Depression and the 1930s (see shaded areas below). The chart below shows the annual Misery Index from 1930 to 2008, calculated as the sum of a) the CPI inflation rate and b) the unemployment rate.

Notice that today’s single-digit Misery Index of 9.7% isn’t anywhere near to the double-digit levels throughout both the 1930s and the 1970s, with peaks around 20% in both decades. The Misery Index is also lower today than during most of the 1980s.

Not to dismiss the current economic contraction, but a long-term perspective on the part of green industry managers is needed. This is the 11th “recessionary” time period over the last 60 years. My point — it is not the first, nor will it be the last — on average they occur every 6 years.

We could even go so far to say they are a part of normal business cycles. A clear-minded, deterministic, strategically visionary mindset will probably be the only thing separating those who survive and those who don’t. Stay tuned to future posts on specific strategies to compete in a down economy!

Yet another successful OFA!

In spite of current economic conditions, attitudes were fairly positive at OFA this week. Several conversations with greenhouse growers across the country once again confirmed the fact that those employing differentiation strategies are holding their own. A few reported anecdotally of sales increases this spring [one said ~20%), with strong carryover into June.

If you missed it, check out the new OFA blog entitled “On Location At Short Course” from the staffs of Greenhouse Grower magazine and Today’s Garden Center magazine.

Click here to view.

Canada welcomes U.S. H-1B skilled workers

According to Tennessee immigration lawyer Greg Siskind, “While our Congress buries its head in the sand and refuses to update our antiquated skilled immigration system, our neighbors to the north are seeking to take advantage of the paralysis. This is just embarrassing.”

Alberta, Canada is now actively recruiting dissatisfied high-skilled H-1B workers in the U.S. (discouraged by sometimes waiting 7 or 8 years for a green card), by promising expedited “Permanent Residency in Canada.

Middle class expanding — globally, that is.

While much attention has been placed on the shrinking middle class here in the U.S., Jim O’Neill, chief economist at Goldman Sachs, offers an interesting commentary of the expanding middle class globally in this weeks Financial Times:

In the midst of the current widespread gloom and doom in the west, it is important not to lose sight of the true structural themes shaping our era.

Linked to the current mood, commentators often depict an embattled and shrinking middle class, with sharply rising financial inequality. However, globally, this is simply not true. One of the most startlingly positive phenomena for many generations continues to unfold around the world. We are in the middle of an explosion of the world’s middle class – about 70m people a year globally are entering this wealth group.

The phenomenon may continue for the next 20 years, with this global middle accelerating to 90m a year by 2030. If this happens, an astonishing 2bn people will have joined the ranks of the middle class. This demonstrates that, contrary to widespread opinion, global inequality is declining significantly, not increasing.

It is important for everyone in the so-called developed world to be constantly aware that these powerful shifts in global wealth are good not only for the developing world, but for them too. If you take a look at a chart of recent US export growth, you may well think you are looking at the wrong data series. But you are not. US exports are indeed growing at close to 20 per cent and it is this that is stopping the housing and credit crunch from driving the US into a deep recession. Aspects of the same phenomenon can be seen in Japan, Germany and even the UK.

The new middle-class explosion is going to remain the market opportunity for us all, or certainly for those of us who are prepared to respond to the new realities.

This, of course, makes trade and regulatory policies all the more important for green industry-related imports and exports. The current APHIS Q37 and other free-trade negotiations (e.g. Columbia) have perhaps even more far-reaching implications than we otherwise surmised. I’ll be speaking at a colloquium at the annual meeting of the American Society for Horticultural Sciences this week discussing this issue in more detail.

Click here for the full FT article.

.