A new on-line course is available that will help growers in making more informed decisions in regard to the AGR-Lite risk management tools/insurance. The course can be taken at your own pace in the comfort of your home or office. As other on-line courses become available, I will attempt to post links to them as well. Click here to view the course website.

Mixed news regarding retail sales

According to the National Retail Federation, retail industry sales for March (which exclude automobiles, gas stations, and restaurants) dipped 0.9 percent unadjusted over last year and were down 0.3 percent from the prior month.

March retail sales released today by the U.S. Commerce Department show total retail sales (which include non-general merchandise categories such as autos, gasoline stations and restaurants) increased 0.2 percent seasonally adjusted from the previous month and increased 0.1 percent unadjusted year-over-year.

“Unseasonably cooler weather created a challenging sales environment for many apparel retailers last month,” said NRF Chief Economist Rosalind Wells. “With the earliest Easter in 95 years, the calendar shift will likely impact April sales as well. In order to get a true picture of retail performance, we will need to look at both March and April sales combined.”

The weak housing market once again had a negative effect on the home furnishing and home improvement categories. Sales at furniture and home furnishing stores decreased 0.3 percent seasonally adjusted from last month and 10.2 percent unadjusted year-over-year. Building material, garden equipment and supplies stores sales decreased 1.6 percent seasonally adjusted from February and 9.6 percent unadjusted from last March.

In spite of the weak selling environment, there were still a few bright spots. Health and personal care stores sales rose 2.8 percent unadjusted from last March but decreased 0.1 percent seasonally adjusted from last month. Sporting goods stores sales also rose 1.5 percent unadjusted year-over-year and 1.4 percent seasonally adjusted month-to-month.

What does this tell us? Consumers will still buy the things that matter most to them! Stay the course. Reports from many parts of the country (undergoing good weather on weekends) points to a favorable spring thus far. Friends in the Northeast do report tougher times however (hurry up spring!).

The results show a cautious household sector, but not one in retreat. Available indexes of consumer attitudes have moved to very low levels — close to or below the lows in the prior two recessions — raising the prospect of a sharp adjustment to consumer spending. However, spending patterns, so far at least, have not softened to the same degree as attitudes.

Gas vs. Education: Which is the better deal?

It has often been touted that education is the key to economic development. Perhaps, one caveat should be added: quality education is the key to economic development.

It has often been touted that education is the key to economic development. Perhaps, one caveat should be added: quality education is the key to economic development.

The American Legislative Exchange Council (ALEC) released its 14th edition of the Report Card on American Education: A State-by-State Analysis, which covers the school years 1985-1986 thru 2006-2007. This comprehensive guide ranks the educational performance of the school systems in the states and the District of Columbia with Minnesota placing first and the District of Columbia last. Findings include:

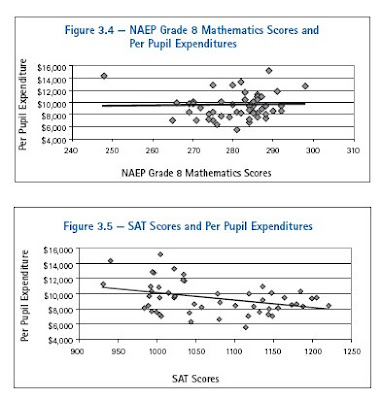

Based on a variety of indicators, ALEC’s 2007 Report Card has found no direct correlation between conventional measures of education inputs, such as expenditures per pupil and teacher salaries, and educational outputs, such as average scores on standardized tests. For instance, class sizes today are 15% smaller than they were 20 years ago, yet of the 10 states that experienced the greatest decreases, only one(Vermont) is found among the highest performing states in the rankings.

Even with dramatic increases in the amount of educational resources spent on primary and secondary education over the past 2 decades–expenditures have risen nationally to an all-time high of $9,295 per pupil–student performance has improved only slightly; 69% of American eighth-graders are still performing below proficiency in math and 71% in reading, according to the 2007 National Assessment of Education Progress.

The latest results of comparison among participating nations of the OECD peg American students’ achievement levels in science below dozens of other countries including Croatia, Latvia, and mainland China. In fact, the United States scores below the combined average of all countries observed.

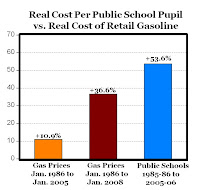

Comment: Based on data in the report from Table 1.6, real Per Pupil Expenditures for public elementary and secondary schools have increased from $6051 in 1985-86 to $9295 in 2005-2006, a 53.61% increase (see graph above). Over the same period, real inflation-adjusted gas prices rose by only 10.9% according to EIA data, from $2.24 per gallon in January 1986 to $2.484 per gallon in January 2006 (the mid-point in the school year). Even adding two more years of real gas price increases and using the January 2008 price of $3.059, real gas prices have only increased by 36.6% since January 1986, far below the 53.6% increase in real public school spending from 1985-86 to 2005-06.

And the quality of gasoline has stayed the same over the last 20 years, which is not necessarily the case with public schools. In fact, the graphs below show that increases in spending have either no effect on test scores (top graph below, taken from the report) or a negative effect on test scores (bottom chart below).

Who won't be around in 10 years?

According to Entrepreneur.com, these businesses are on their way out…are there lessons we can learn from them? Click here for more.

- Record stores

- Camera film manufacturing

- Crop dusters

- Newspapers

- Pay phones

- Used bookstores

- Piggy banks

- Telemarketing

- Coin-operated arcades

Columbian Free Trade Debate

Colombian flower exports, which represent about 60 percent of flowers sold in the U.S., currently enjoy duty-free access to U.S. markets under the Andean Trade Preference and Drug Eradication Act (ATPDEA). That act is set to expire on Dec. 31, 2008.

If it is not renewed, or if Congress does not approve the U.S./Colombia FTA sent by President Bush on Monday, U.S. floral importers of record will have to pay duties on Colombian flowers entering this country. Under federal law governing implementation of the U.S./Colombia Free Trade Agreement (FTA), Congress now has 90 legislative days to vote for or against the measure.

Currently, the FTA is embraced by the National Association of Manufacturers and the National Chamber of Commerce. Anti-trade Democrats already oppose the pact because they believe the Colombian government has not done enough to reduce violence in the country, especially against trade unionists. Thus, the issue has become a political hot potato.

From an economic perspective, however, a Colombia FTA is in the best interest of both countries. It eliminates tariffs and strengthens the rights of American exporters while giving Colombians predictability in their relationship with us, their largest trading partner.

This agreement would give our exporters the same duty-free access to the Colombian market. It creates an even playing field for U.S. businesses, farmers and workers who now pay hundreds of millions of dollars in duties on their exports to Colombia each year—duties that will be eliminated with the FTA. This agreement also increases investor rights, strengthens the rule of law and reinforces Colombia’s democracy and stability.

For a brief (3-page) summary of the agreement, click here.

Exploring the psychological "rules" of pricing

Even wonder why retailers price goods at $4.99 rather than $5.00? There may be a good reason – establishing the increment of comparison around the price anchor. In the April 2008 issue of Scientific America, an article by Wray Herbert explores this issue.

One of Alfred Hitchcock’s most enduring bits of cinematic comedy is the auction scene in the espionage thriller North by Northwest. Cary Grant plays Roger Thornhill, a businessman who has been mistaken for a CIA agent by the ruthless Phillip Vandamm. At a critical juncture, Thornhill is cornered by his enemies inside a Chicago auction house, and the only way he can escape is by drawing attention to himself. When the bidding on an antique reaches $2,250, Thornhill yells out, “Fifteen hundred!” When the auctioneer gently chides him, he loudly changes his bid: “Twelve hundred!” When the bidding on a Louis XIV chaise longue reaches $1,200, Thornhill blurts outs, “Thirteen dollars!” The genteel crowd is outraged, but Thornhill gets precisely what he wants: the auctioneer summons the police, who “escort” him past Vandamm’s henchmen to safety.

Clever thinking and good comedy. It is funny for a lot of reasons, and one is that Thornhill violates every psychological “rule” for how we negotiate price and value with one another. So much of life involves “auctions,” whether it is buying a used car or making health care choices or even choosing a mate. But, unlike Roger Thornhill, most of us are motivated by the desire for a fair deal, and we employ some sophisticated cognitive tools to weigh offers, fashion responses, and so forth—all the to-and-fro in getting to an agreement.

But how does life’s dickering play out in the brain? And is it a trustworthy tool for getting what we want? Psychologists have been studying cognitive bartering for some time, and several basics are well established. For example, an opening “bid” of any sort is usually perceived as a mental anchor, a starting point for the psychological jockeying to follow. If we perceive an opening bid as fundamentally inaccurate or unfair, we reject it by countering with something in another ballpark altogether. But what about less dramatic counter offers? What makes us settle on a response?

University of Florida marketing professors Chris Janiszewski and Dan Uy suspected that something fundamental might be going on, that some characteristic of the opening bid itself might influence the way the brain thinks about value and shapes bidding behavior. In particular, they wanted to see if the degree of precision of the opening bid might be important to how the brain acts at an auction. Or, to put it in more familiar terms: Are we really fooled when storekeepers price something at $19.95 instead of a round 20 bucks?

Janiszewski and Uy ran a series of tests to explore this idea. The experiments used hypothetical scenarios, in which participants were required to make a variety of “educated guesses.” For example, they had subjects think about a scenario in which they were buying a high-definition plasma TV and asked them to guesstimate the wholesale cost. The participants were told the retail price, plus the fact that the retailer had a reputation for pricing TVs competitively.

There were three scenarios involving different retail prices: one group of buyers was given a price of $5,000, another was given a price of $4,988, and the third was told $5,012. When all the buyers were asked to estimate the wholesale price, those with the $5,000 price tag in their head guessed much lower than those contemplating the more precise retail prices. That is, they moved farther away from the mental anchor. What is more, those who started with the round number as their mental anchor were much more likely to guess a wholesale price that was also in round numbers. The scientists ran this experiment again and again with different scenarios and always got the same result.

Why would this happen? As Janiszewski and Uy explain in the February issue of Psychological Science, people appear to create mental measuring sticks that run in increments away from any opening bid, and the size of the increments depends on the opening bid. That is, if we see a $20 toaster, we might wonder whether it is worth $19 or $18 or $21; we are thinking in round numbers. But if the starting point is $19.95, the mental measuring stick would look different. We might still think it is wrongly priced, but in our minds we are thinking about nickels and dimes instead of dollars, so a fair comeback might be $19.75 or $19.50.

The psychologists decided to check these lab findings in the real world. They looked at five years of real estate sales in Alachua County, Florida, comparing list prices and actual sale prices of homes. They found that sellers who listed their homes more precisely—say $494,500 as opposed to $500,000—consistently got closer to their asking price. Put another way, buyers were less likely to negotiate the price down as far when they encountered a precise asking price. Furthermore, houses listed in round numbers lost more value if they sat on the market for a couple of months. So, bottom line: one way to deal with a buyer’s market may be to pick an exact list price to begin with.

Employment down: Does this spell recession?

he unemployment rate rose from 4.8 to 5.1 percent in March, and nonfarm payroll employment continued to trend down (-80,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported Friday. Over the past 3 months, payroll employment has declined by 232,000.

In March, employment continued to fall in construction, manufacturing, and employment services, while health care, food services, and mining added jobs. Average hourly earnings rose by 5 cents, or 0.3 percent, over the month.

The number of unemployed persons increased by 434,000 to 7.8 million in March, and the unemployment rate rose by 0.3 percentage point to 5.1 percent. Since March 2007, the number of unemployed persons has increased by 1.1 million, and the unemployment rate has risen by 0.7 percentage point.

So that’s the bad news. Now for some perspective. The magnitude of the employment decline is pretty small: less than 2/10s of one percent from the peak in December through March. So don’t think of massive layoffs; think of minor adjustment. (I know that to people who have lost their jobs, it feels pretty massive.)

The Wall Street Journal was more inane than usual. They noted the 80,000 decline in jobs and said, “Had it not been for a rise in government jobs last month, payrolls would have fallen by around 100,000.” Let me add that had it not been for the drop in construction employment, payrolls would only have fallen by 29,000. Did you learn anything from this? I didn’t think so.

How should business plans be adjusted now?

Now that you’ve looked at the forest, spend more time with your trees. Look at your own sales by segment and geography. Watch your customers’ sales closely. There’s plenty of variety of there; you need to know whether you are in the happy side of the economy (and there certainly is one) or the sad side.

So does this spell recession? I can only say at this point…maybe. Next month we could (not likely, but possible) see an expansion of employment, followed by nothing but expansion for the rest of the year. If that happens, then we’ll look at these three months of decline and say “blip” rather than “recession.” So anyone who says that we are definitely in a recession now is making a forecast about the next few months. They are probably right, but bear in mind they’re making a forecast, not reading hard data.

FYI — Distinguished Lecture 4/09/08

The fifth lecture in the Distinguished Lecture Series sponsored by the Ellison Chair in International Floriculture will be presented by Dr. Peter Bretting, the USDA/ARS National Program Leader for Plant Germplasm and Genomes. The title of his Lecture is Horticultural Genetic Resources: Current Status and Future Prospects.

A reception will be held at 2:30 p.m. in the Horticulture/Forest Science Building atrium on Wednesday, April 9, followed by his Lecture at 3:00 p.m. in room 102 HFSB on the West Campus of Texas A&M; University.

Dr. Bretting has been USDA/ARS National Program Leader, Plant Germplasm and Genomes since 1998, and was promoted to the rank of Senior National Program Leader in 2004. This position involves co-leadership, coordination, and direction of a national program of crop genetic research conducted at more than 50 locations nationally, with an annual budget of approximately $120 million.

He also serves as a USDA representative for the US government delegations negotiating the UN-FAO International Treaty for Plant Genetic Resources for Food and Agriculture, and the UN-UNEP Convention on Biological Diversity.

His areas of research specialization and professional interest include: 1) Administration and management of scientific research, development, and service organizations; 2) Plant genetic resource management, emphasizing statistical genetic and molecular marker approaches to managing germplasm; 3) Crop genetics, genomics, systematics, and economic botany, with particular emphasis on maize, sunflowers, and new crops, especially ornamentals. He is the co-editor of one book and a collection of papers, and the author or coauthor of numerous scientific publications.

Click here to view the online Distinguished Lecture announcement. Please feel free to distribute this announcement to whom you deem appropriate.

How not to save housing…

I have pontificated previously regarding the value that landscaping provides in increasing perceived home values by enhancing curb appeal, etc. (see value of landscaping in the sidebar). In recent months, I have also reported on the record decline in home values. Intuitively, those who have landscaped their homes “properly” may have offset the devaluation of their home to some degree.

But several Congressional proposals seek to adjust home values artificially by authorizing the Federal Housing Administration (FHA) to guarantee $300 billion of new home loans to strapped homeowners, allowing them to refinance their existing mortgages at lower rates and lower outstanding amounts. Under it, homeowners who borrowed from Jan. 1, 2005 to July 1, 2007 would be eligible for new loans if their monthly payments of interest and principal exceeded 40 percent of their income, well above a more prudent level of 30 percent.

Everyone wins from this arrangement, say its supporters. Homeowners (some perhaps victims of deceptive lending practices) stay in their houses. Neighborhoods don’t suffer the potential blight of numerous foreclosures. Housing prices don’t go into a free fall, depressed by an avalanche of foreclosures. Although lenders take a loss, the losses are lower than they would be if homes went into foreclosure.

But Bob Samuelson provides a differing perspective, saying not only does not make good moral sense, but less economic sense:

About 50 million homeowners have mortgages. Who wouldn’t like the government to cut their monthly payments by 20 percent or 30 percent? But Frank’s plan reserves that privilege for an estimated 1 million to 2 million homeowners who are the weakest and most careless borrowers. With the FHA now authorized to lend up to $729,750 in high-cost areas, some beneficiaries could be fairly wealthy. By contrast, people who made larger down payments or kept their monthly payments at manageable levels would be made relatively worse off. Government punishes prudence and rewards irresponsibility. Inevitably, there would be resentment and pressures to extend relief to other “needy” homeowners.

The justification is to prevent an uncontrolled collapse of home prices that would inflict more losses on lenders — aggravating the “credit crunch” — and postpone a revival in home buying and building. This gets the economics backwards. From 2000 to 2006, home prices rose by 50 percent or more by various measures. Housing affordability deteriorated, with home buying sustained only by a parallel deterioration of lending standards. With credit standards now tightened, home prices should fall to bring buyers back into the market and to reassure lenders that they’re not lending on inflated properties.

If rescuing distressed homeowners delays this process, the aid and comfort that government gives some individuals will be offset by the adverse effects on would-be homebuyers and overall housing construction. Of course, there are other ways for the economy to come to terms with today’s high housing prices: a general inflation, which would lift nominal (but not “real”) incomes; or mass subsidies for home buying. Neither is desirable.

None of this means that lenders and borrowers shouldn’t voluntarily agree to loan modifications that serve the interests of both. Foreclosure is a bad place for most creditors or debtors. Although the process is messy, promising to lubricate it with massive federal assistance may retard it as both wait to see if they can get a better deal from Washington, which would then assume the risk for future losses.

Standards Committee deadline extended

Due to increased interest in the development of the Sustainable Agriculture Practice Draft American National Standard for Trial Use, the deadline has been extended for applications to participate on the Standards Committee and/or supporting subcommittees to May 23, 2008.

This extension is being implemented based on numerous requests to allow time for additional stakeholders to submit their applications. To learn more, click here for the official deadline extension announcement and click here for the Leonardo Academy press release announcing the call for Standards Committee applicants.

Why is it important to get involved? Ever heard the phrase “taxation without representation”? Need I say more?

SAF and OFA have great summary websites if you need to get caught up on this critical issue.