Today, the Commerce Department’s retail-sales report showed an overall 0.2% decline BUT exhibited a 0.5% increase when auto sales were excluded.The resilience of the consumer seen in today’s report is particularly encouraging given that this number largely represents spending that occurred prior to the receipt of the economic stimulus rebates. While it’s conceivable that some spending may have been pulled forward in anticipation of the rebate checks, survey responses and historical experience suggest these outlays occur only after the checks have been received.

Mother's Day radio segment

Click here to listen to a short Mother’s Day radio story developed through the Texas Department of Agriculture.

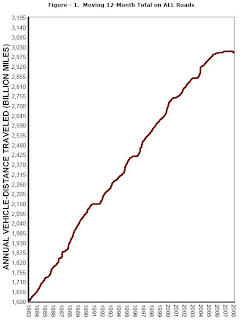

Gas prices actually do influence driving behavior

The chart below shows the annual vehicle traffic volume, measured in billions of miles traveled in the U.S., on a moving 12-month basis through February 2008 from the Federal Highway Administration. The flat trend in traffic volume over the last year or more, along with the declines in each of the last four months through February 2008, appears to be the most significant adjustment to traffic volume in any comparable period during the last 25 years. High gas prices appear to be having an effect on driving habits.

Other behavior changes:

More bicycles are being sold.

More folks are taking mass transit.

More small cars are being sold.

2007 NGA Study is available

According to results of the recently completed 2007 National Gardening Survey retail sales of lawn and garden products to consumers totaled $35.102 billion last year. That was an increase of 3 percent or $1.025 billion more than the $34.077 billion consumers spent on lawn and garden products in 2006.

Nationwide, 71 percent of all U.S. households or an estimated 82 million households participated in one or more types of lawn and garden activities in 2007 — 3 million fewer households than the five-year average of 85 million participating households recorded from 2002 to 2006. The most popular lawn and garden activities in 2007 included lawn care (48% of households), growing indoor houseplants (31% of households), flower gardening (30% of households), and landscaping (27% of households).

Consumers spent an average of $428 per household on do-it-yourself lawn and garden activities in 2007, or 7 percent more than the $401 average spent in 2006. Households that spent the most on their lawns and gardens in 2007 included people 55 years of age and older, college graduates, married households, households with annual incomes of $75,000 and over, households in the South, two-person households and households with no children at home.

The 2007 study was based on a survey with a representative sample of 2,049 U.S. households conducted by Harris Interactive for the National Gardening Association. For more information or to obtain your copy, go to www.gardenresearch.com.

Your taste buds are in your wallet

My good friend, Stan Pohmer, emailed today with a blurb from the April 28 issue of BusinessWeek (see below). He then asked “Do you think the same mindset applies to floral products?” An interesting notion for sure. Let’s take a quick look at the short article (below) and then I’ll comment on Stan’s question.

Your Taste Buds Are In Your Wallet

Is that Rubicon Estate cabernet worth the $80 you may have paid? The answer lies within the folds of your medial prefrontal cortex. A recent study conducted by researchers at Stanford Graduate School of Business and the California Institute of Technology concludes that when people know a wine is expensive, the pleasure they get from it is enhanced in the area of the brain where such sensations are processed. In the study, published online earlier this year in the Proceedings of the National Academy of Sciences, students were placed in an MRI machine and given sips of red wine–including the same one presented twice, with two different price tags: $5 (the actual bottle price) and $45 (a fiction). The subjects all said they liked the “expensive” wine better–a preference mirrored by increased activity in their prefrontal cortexes. The lesson, says Baba Shiv, an associate professor of marketing at Stanford: “There’s a temptation among marketers to keep reducing prices. We’re saying be careful before you embark on that strategy.” -Steve Hamm

Now bear in mind, Stan, that I am no medical doctor but even the neophyte knows the medial prefrontal cortex region of the brain has been implicated in planning complex cognitive behaviors, personality expression, and moderating correct social behavior. The most typical neurological term for functions carried out by the prefrontal cortex area is executive function. Executive function relates to abilities to differentiate among conflicting thoughts, determine good and bad, better and best, same and different, etc.

In the marketing literature, it is a commonplace observation that in many markets where consumers are not fully informed about product quality (e.g. safety, durability, probability of being satisfied) prior to purchase, goods sold at relatively high prices tend to be associated with high quality. In other words, price acts as a quality signal — in both directions.

It seems to me that the wine example fits this model perfectly since the novice wine drinker knows very little about what constitutes “quality.” They merely associate a higher price with a higher quality wine — at least until they take a wine tasting class. In the same way, the average buyer of floral products knows very little [in my humble opinion] about what constitutes a “quality” flower and in the absence of grades and standards to tell them what is quality and what is not, they will naturally gravitate to the same price signaling measure of quality as the novice wine buyer.

If this is indeed the case, much money is being left on the table.

Gas tax holiday is NOT the answer

In case you’re wondering where I stand on the proposed proposed gasoline tax holiday, it would save the average individual motorist a grand total of $28 this summer, but would result in $9 billion in lost tax revenues which would be mostly targeted for infrastructure needs. This is a politically motivated move, not a well-thought-out economic decision. Enough said.

Data source: American Association of State Highway and Transportation Officials

How to Sell Services More Profitably

In the May issue of Harvard Business review, an article by Reinartz et al. puts forth the notion that firms frequently believe that adding value in the form of services will provide a competitive advantage after their products start to become commodities. When the strategy works, the payoffs are impressive, and a company may even discover that its new service business makes more money than its products. But for every success story, anecdotal cautionary tales remind us that most companies will most likely struggle to turn a profit from their service businesses.

Companies unsuccessful at developing service profitability have tried to transform themselves too quickly. Successful firms begin slowly, identifying and charging for simple services they already perform and using those to build enthusiasm for adding more-complex ones.

They then standardize their delivery processes to be as efficient as possible. As their services become more complex, they ensure that their sales force capabilities keep pace.

Finally, management switches its focus from the company’s processes and structures to the nature of customers’ problems, the opportunities that customers’ processes afford for inserting new services, and the new capabilities needed to deliver those services. In other words, they take partnering to the next level (See the exhibit below –click for larger view)

Reasons for rising food prices

Ok, I realize that this post might seem peculiar at first given that this is a green industry oriented blog. But remember that the supply chain for our products is quite similar to that of perishable foods. Therefore, logically, any supply chain dynamics affecting one industry must also affect the other. Given that premise, let’s proceed.

Much attention has been placed in the media on the fact that market prices for major food commodities such as grains and vegetable oils have risen sharply to historic highs of more than 60 percent above levels just 2 years ago. Many factors have contributed to the runup in food commodity prices. Some factors reflect trends of slower growth in production and more rapid growth in demand, which have contributed to a tightening of world balances of grains and oilseeds over the last decade.

Recent factors that have further tightened world markets include increased global demand for biofuels feedstocks and adverse weather conditions in 2006 and 2007 in some major grain and oilseed producing areas.

Other factors that have added to global food commodity price inflation include the declining value of the U.S. dollar, rising energy prices, increasing agricultural costs of production, growing foreign exchange holdings by major food importing countries, and policies adopted recently by some exporting and importing countries to mitigate their own food price inflation.

In assessing prospects for the future, there are a number of uncertainties and concerns:

Global economic growth: If rapid growth continues, particularly in developing countries, it will continue to put upward pressure on food commodity prices through increases in food demand.

Energy prices: If petroleum prices continue to rise, costs of agricultural production will rise, as will the cost of processing, and the cost of transporting products to markets both within a country and exporting to other countries. Continued high petroleum prices will also sustain the global incentives to produce more biofuels.

Biofuels production: In USDA’s 10-year agricultural projections, global growth in biofuels production begins to slow in the next several years and production from grains and oilseeds flattens out in the next half decade. World food commodity prices are not projected to retreat to past levels. However, several years into the future, the underlying long-term trend in rapidly increasing global demand is expected once again to be the primary contributor to future upward pressure on food commodity

prices.

Supply response capacity of the global agricultural production system:

• Cost of inputs: Continued increases in production costs, especially in energy-related costs, will restrain the world’s production response. Higher costs for fertilizer, fuel, and seeds could cause farmers without access to credit to plant less than they otherwise would have, or to shift to crops requiring fewer inputs.

• Additional cropland (quantity and quality): What will be the long-run impact of higher world food commodity prices on the amount of land used to produce the crops? What is the productivity of the land that will be used to increase production?

• Water shortages: How quickly will constraints on the amount of water available for agricultural production become more widespread?

• New seed varieties and use of biotechnology: Will higher food prices encourage some countries to adopt the use of biotechnology, especially genetically modified seed for crops? Will future research focus more on yield-enhancing varieties rather than cost-reducing innovations?

• Biophysical response to climate change: How will climate change affect agricultural production? How will it change temperatures, precipitation, the length of growing seasons, and variability of yields? How, and under what circumstances, will climate change increase and/or reduce production? In affected regions, how difficult will it be for producers to shift to different crops, to adopt new cropping patterns, and to adjust production practices to the new environment?

With such low world stocks of food commodities, food prices are vulnerable to a production shortfall in one or more major production areas. If a significant shortfall occurs this year due to weather or disease, food prices might continue to rise sharply from the current high level.

Although trade flows can mitigate some of these effects, new or existing trade restrictions or barriers can exacerbate price impacts. However, if good crop production conditions exist in the Northern Hemisphere during the next 6 months, food commodity prices could retreat significantly from their current highs.

Mother's Day Projections

Here is a scoop on a news release coming out today by our Texas AgriLife Communications Team:

Experts Say Things Looking Rosy for Texas Floriculture This Mother’s Day

Author: Paul SchattenbergWhile research shows U.S. consumers expect to spend a bit less on Mother’s Day this year, that likely will not affect the purchase of cut flowers and flowering plants for moms in Texas, according to industry experts.

According to the 2008 Mother’s Day Consumer Intentions and Actions Survey conducted by BIGresearch for the National Retail Federation, Americans expect to spend an average of $138.63 on Mom this year. This is slightly down from the 2007 average of $139.14.

But although a nationwide reduction in consumer spending for Mother’s Day is expected, those associated with the Texas green industry expect flower purchases to be as good or better than in 2007.

Dr. Charles Hall, Professor and Ellison Chair in International Floriculture at Texas A&M; University, said he expects the Texas floral industry to fare well this Mother’s Day due to a combination of timing and consumer confidence.

“In spite of the downturn in consumer spending for Mother’s Day predicted in the National Retail Federation survey, the same survey shows Americans intend to still spend more than $2 billion on flowers this Mother’s Day,” he said.

Hall added that the 2007 NRF study showed more than 72 percent of those surveyed purchased some sort of Mother’s Day flora at an average retail price of $27.59.

“Other gifts like jewelry, CDs, housewares and the like tend to be spread out among the holidays, but flowers are a traditional choice for holidays centered around women,” he said. Hall also noted that overall consumer confidence is still high in Texas and that the likelihood of consumers purchasing flowers and other floral items “directly correlates” to that confidence.

“Not only that,” he said, “but (economic stimulus) rebate checks are now being mailed out and that will give more impetus to spending. Some of that money will go toward Mother’s Day gifts, which would include flowers.”

“Even with the slowdown in the economy, the amount that will be spent on flowers for Mother’s Day throughout Texas probably will be as much or more than last year,” said Jack Cross, past president of the Texas State Florists’ Association and owner of Arthur Pfeil Florist in San Antonio. “Mother’s Day is a traditional holiday, and the Texas consumer is traditional about Mother’s Day gift purchases, especially when it comes to buying flowers.”

In addition, Easter came much earlier this year than in years past, giving more time for the consumers to “recover” before their Mother’s Day flower purchase, Cross added.

When it comes to cut flowers, Texans usually prefer buying roses, carnations, tulips and lilies for Mom from their neighborhood florist, he said. Azaleas, begonias and Calla lilies are among the most popular flowering plants purchased.

“If someone is going to buy from a garden center instead of a floral shop, then that purchase will usually be something like a rose bush or a hibiscus plant,” he said.

While the product mix between Valentine’s Day and Mother’s Day couldn’t be more different, the sales dollars generated from each are about the same, said Stan Pohmer, executive director of the national Flower Promotion Organization, based in Minnetonka, Minn.

“Mother’s Day accounts for about 25 percent of all floral holiday sales,” Pohmer said. Cut flowers represent about 46 percent of Mother’s Day floral transactions, outdoor bedding plants and hanging baskets represent about 37 percent, and flowering house plants and foliage represent about 15 percent.

Pohmer added that 64 percent of Mother’s Day flower purchases are made by women. However, he cautioned, floral sales in general may not be as sure-fire in the future as they have been in the past.

“While the floral industry has previously thought of itself as recession-proof, a more realistic term these days would probably be recession-resistant,” he said.

But in the Lone Star State, flower producers, greenhouse growers and retailers are all poised to make sure Texas moms gets their mums – or whatever floral they desire.

“Things look good this year for flower retailers and the greenhouse floral industry in Texas,” said Richard de los Santos, state marketing coordinator for horticulture with the Texas Department of Agriculture. “Flower growers are pretty well sold out of product and have made commitments to their retailers.”

“There seems to be a growing desire for people to give plants that continue to live and give,” said Marilyn Good, communications director for the Texas Nursery and Landscape Association in Austin. “Blooming potted plants are gaining favor, and the real up-and-coming gift plant is the orchid, which has a hard-to-grow reputation, but many are low maintenance.”

David Rodriguez, Texas AgriLife Extension Service horticulturist for Bexar County, agrees mothers often prefer potted plants or bedding plants to cut flowers.

“Some good choices for live plants for Mother’s Day might be Belinda’s Dream and Grandma’s Yellow roses, which are Texas SuperStar plants. This means, among other things, they are attractive, unique flowering plants suited to Texas. And they consistently perform well, regardless of a person’s gardening expertise.”

Other Texas SuperStar plants that may serve as good selections are the ‘Gold Star’ Esperanza and Perennial Hibiscus, he said. And the moth orchid makes a good choice for a beautiful, low-maintenance indoor flowering plant.

“But regardless of flower selection, there is always something unique about Mother’s Day,” added Hall. “Mother’s Day tends to supercede economic concerns in a ways other holidays do not. People know they can always rely on Mom during the tough times, so they aren’t going to forget that when Mother’s Day comes around.”

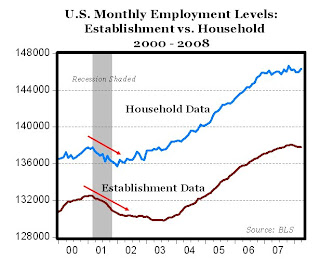

Latest labor data doesn't support recession scenario

From today’s BLS employment report, here’s what probably won’t get reported. According to the more comprehensive Household Survey Data (which unlike the establishment data, includes the self-employed, unpaid family workers, agricultural workers, and private household workers), there were 146.331 million Americans employed in April (see chart below), which is 618,000 higher than April of last year (145.733 million jobs) and 362,000 higher than March of 2008 (145.969 million). Note also what happened to employment levels for both measures during the 2001 recession. Much different than 2008. Hmmmm.

Also, in case you’re wondering. Neither the establishment nor household survey is designed to identify the legal status of workers. Thus, while it is likely that both surveys include at least some undocumented immigrants, it is not possible to determine how many are counted in either survey.