From today’s NT Times: In what automobile industry analysts are calling a first, about one in five vehicles sold in the United States was a compact or subcompact car during April, based on monthly sales data released Thursday. Almost a decade ago, when sport utility vehicles were at their peak of popularity, only one in every eight vehicles sold was a small car. Click here for full story.

Starting Salaries for College Graduates

I always have discussions this time of year with participants in the green industry who are looking for bright, energetic college graduates to work in their business. Of course, they always ask how much should they expect to pay. Relative to other disciplines, starting salaries for horticulture students probably fall somewhere slightly below the middle of the spectrum below, averaging around $35,000. Then again, if we’re really talking about the best and brightest, those students usually come at $5-8K premium, particularly those with an internship or two under their belt. After a year of so on the job, of course, this usually goes up dramatically for those who make the cut.

Yet another 1/4 point

The Federal Reserve lowered the benchmark U.S. interest rate by a quarter point to 2 percent and indicated it’s ready to pause after seven cuts since September. It said that “economic activity remains weak,” but added that its measures “should help to promote moderate growth over time.”

The action came just hours after the Commerce Department reported that gross domestic product GREW in the first quarter. The increase was a meager 0.6%, the same as in the fourth quarter of 2007, but it was still above zero. It may be semantics, but just the same, don’t count on any official recession announcement any time soon!

We economists sifted the Fed’s statement for hints of whether the Fed was done cutting but there were no obvious clues, indicating that the Fed doesn’t want to paint itself into a corner on future actions.

Also noticeably absent was any mention of recession. It said, “Household and business spending has been subdued and labor markets have softened further. Financial markets remain under considerable stress, and tight credit conditions and the deepening housing contraction are likely to weigh on economic growth over the next few quarters.” On inflation, the Fed said it “expects inflation to moderate in coming quarters.”

Regional Outlook is Mixed

If there are strengths in any regional economies, they are largely in two areas emanating from Texas. The first extends to the north all the way to North Dakota. The mid-section of the country is supported by high prices for a broad array of commodities—oil, wheat, corn, and industrial metals, to name a few. There is barely any weakness in any of the large or small metropolitan areas of this region. The second is to the east, extending from Texas to Georgia and the Carolinas. The stability of this area arises from the lack of a housing bubble during past years, which left house prices rather stable and the market less exposed to subprime lending. But in this region, the strength is less uniform. Where considerable investment is taking place, such as in Mobile or Huntsville, AL, or Raleigh, NC, the economies are doing well. Where there is considerable exposure to the manufacture of housing and construction-related materials or to import competition, then it is hard to avoid some weakness. And where there was some overbuilding of housing, as in Atlanta, the economy is more susceptible to a slowdown.

Cracks are widening in some regional labor markets of the West and South. Through February, new claims for unemployment insurance—a proxy measure for layoffs—were rising fastest in those two regions. The rise in new claims in each was about as fast as it was as when the economy entered the 2001 recession. Much of this has to do with both areas’ high exposure to housing-related industries and their weak housing markets. However, with a 20% rise in each region, it seems to be approaching a scale that reaches beyond housing and closely related industries.

Downside risks are prevalent in most regions as consumer spending weakens. This is particularly evident on the West Coast and in Florida, Washington, D.C., and the Northeast, where strong borrowing against home equity in 2005 and 2006 had bolstered spending. The Northeast’s risk is compounded by impending layoffs and weaker income generated by investment banking. Risks will rise more broadly across the country as consumer credit quality falters and other sources of cash for spending disappear. Additionally, if business confidence remains as weak as it is, a falloff in investment spending will hurt the industrial Midwest and centers of tech-producing industries on the coasts and in Texas.

As I have stated in earlier posts, some regions of the country are faring well considering the circumstances. Regardless of what situation you find yourself in, maintain your marketing strategy (or even expand it). Stay the course.

Graphs sources: Moody’s.com

Good Advice Sid!

On the OpenRegister blog, Sid Raisch, president of consulting firm Horticultural Advantage, offers some tips for retailers to keep in mind during these tight economic conditions. Click here for his comments.

Better Roses Than Cocaine

Nicholas Kristof, columnist for the New York Times, presents his view of the political nature of the Columbian free trade agreement debate and makes a case for the economic contributions of Columbian exports (e.g. the rose industry) in creating jobs and building national security. Click here for the full story.

No Company is an Island

For the twelve weeks from January 23 to April 16, 2008, HBRGreen (the sustainability arm of the Harvard Business Review) hosted six discussions on the emerging intersection of business and the environment. Leaders of the business world asked provocative questions and readers from around the globe answered with robust and lively commentaries, bringing an unparalleled level of insight and experience to the conversation. Click here to glean important sustainable directives for your business.

Mother's Day Consumer Intentions

According to the National Retail Foundation’s 2008 Mother’s Day Consumer Intentions and Actions Survey conducted by BIGresearch, consumers will spend an average of $138.63 this year, compared to $139.14 last year. Total consumer spending is expected to reach $15.8 billion.

When it comes to popular gifts, consumers will shell out nearly $3.0 billion on a special dinner or brunch, $1.2 billion on consumer electronics like digital cameras, digital photo frames and video cameras, $2.0 billion on flowers, $1.4 on clothing and accessories and $1.1 billion on personal service gifts like a trip to a favorite spa or salon. Shoppers will also spend $1.6 billion on gift cards/gift certificates, $696 million on housewares and gardening tools and $672 million on greeting cards.

For the complete survey results, click here.

Ellison Chair Distinguished Lecture Series

The 5th lecture in the Distinguished Lecture Series sponsored by the Ellison Chair in International Floriculture was given Dr. Peter Bretting, USDA/ARS Senior National Program Leader, Plant Germplasm and Genomes. The lecture was entitled “HORTICULTURAL GENETIC RESOURCES: CURRENT STATUS AND FUTURE PROSPECTS.” Dr. Bretting’s position involves co-leadership, coordination, and direction of a national program of crop genetic research conducted at more than 50 locations nationally, with an annual budget of approximately $120 million. He also serves as a USDA representative for the US government delegations negotiating the UN-FAO International Treaty for Plant Genetic Resources for Food and Agriculture, and the UN-UNEP Convention on Biological Diversity. To view this or previous Distinguished Lectures, click here. To view the summary press release, click here.

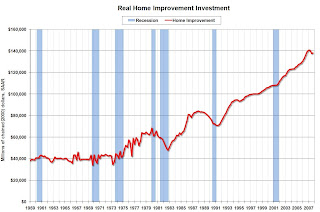

Home Remodeling Spending Down

From Dow Jones: Home-Remodeling Spending To Fall 4.8% Through ’08 – Study

Home-improvement spending is unlikely to improve until 2009, and the second half of 2008 is shaping up to be weaker than the first, according to Harvard University’s Joint Center for Housing Studies.

Falling consumer confidence and a weakening economy are inhibiting remodeling spending, which is expected to fall by an annual rate of 4.8% through the end of 2008, the center said Thursday. That is steeper than the 2.6% annualized decline the center projected through the third quarter when it last updated its Leading Indicator of Remodeling Activity in January.

This might be optimistic for several reasons. First, falling house prices and the inability for homeowners to borrow against their homes (mortgage equity withdrawal) are probably “inhibiting remodeling spending” more than the weakening economy and consumer confidence.

Second, we have recently seen warnings from Home Depot and Lowe’s that suggest same store sales are falling off a cliff (about 8% year-over-year).

And third, the Joint Center for Housing Studies forecast is mild compared to declines in home improvement spending during previous housing busts.

This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue (source: BEA)

As of Q4 2007, real spending on home improvement had held up pretty well (only off 2% in real terms from the peak). If this housing bust is similar to the early ’80s or ’90s, real home improvement investment may very well slump 15% to 20%.

Yes, the Joint Center for Housing Studies forecast is in nominal terms, but it appears they believe this slump in home improvement will be milder than the downturns during the previous two housing busts (early ’80s and early ’90s).