The Federal Reserve lowered the benchmark U.S. interest rate by a quarter point to 2 percent and indicated it’s ready to pause after seven cuts since September. It said that “economic activity remains weak,” but added that its measures “should help to promote moderate growth over time.”

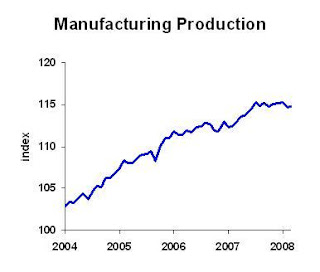

The action came just hours after the Commerce Department reported that gross domestic product GREW in the first quarter. The increase was a meager 0.6%, the same as in the fourth quarter of 2007, but it was still above zero. It may be semantics, but just the same, don’t count on any official recession announcement any time soon!

We economists sifted the Fed’s statement for hints of whether the Fed was done cutting but there were no obvious clues, indicating that the Fed doesn’t want to paint itself into a corner on future actions.

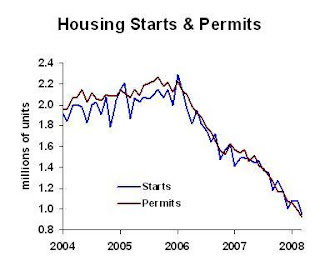

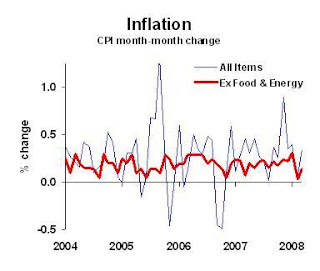

Also noticeably absent was any mention of recession. It said, “Household and business spending has been subdued and labor markets have softened further. Financial markets remain under considerable stress, and tight credit conditions and the deepening housing contraction are likely to weigh on economic growth over the next few quarters.” On inflation, the Fed said it “expects inflation to moderate in coming quarters.”