The federal debt ceiling is a looming catastrophe one day and a crisis averted the next. It seems a never-ending cycle. WSJ’s David Wessel explains the basics of the debt limit and why you should care…click here.

Housing multiplier effects

People frequently ask how a sector that currently accounts for 2.5% of the US economy can be so important. First, residential investment has large swings during the business cycle, and will probably increase sharply over the next few years. Second, there are spillover effects from housing – meaning housing has a much larger impact on overall economic activity than just “residential investment”.

We are starting to see some signs of spillover from Kate Linebaugh and James Hagerty at the WSJ: From Power Tools to Carpets, Housing Recovery Signs Mount

Companies that sell power tools, air conditioners, carpet fibers, furniture and cement mixers are reporting stronger sales for the fourth quarter, providing further evidence that a turnaround in the housing market is taking hold…. executives at companies exposed to housing are growing more optimistic. Improvement in the sector could help broad tracts of the economy by creating jobs, improving consumer confidence and boosting property-tax receipts for municipalities. Construction typically is a big job creator during expansions, though the industry has been slow to staff up during the current recovery.

“The housing recovery will help lift businesses that have long been dormant,” said Mark Vitner, senior economist at Wells Fargo. “People will be fixing up homes to put them up for sale—buying new air conditioners, painting, fixing roofs. As the new-home market picks up, that really feeds into [gross domestic product].”

Abbott & Costello Economics

Unemployment is dropping — as explained by Bud & Lou:

Unemployment is dropping — as explained by Bud & Lou:

COSTELLO: I want to talk about the unemployment rate.

ABBOTT: Good Subject. Terrible times. It’s 9%.

COSTELLO: That many people are out of work?

ABBOTT: No, that’s about 20%.

COSTELLO: You just said 9%.

ABBOTT: 9% Unemployed.

COSTELLO: Right 9% out of work.

ABBOTT: No, that’s about 20%.

COSTELLO: Okay, so it’s 20% unemployed.

ABBOTT: No, that’s 9%…

COSTELLO: WAIT A MINUTE. Is it 9% or 20%?

ABBOTT: 9% are unemployed. 20% are out of work.

COSTELLO: IF you are out of work you are unemployed.

ABBOTT: No, you can’t count the “Out of Work” as the unemployed. You have to look for work to be unemployed.

COSTELLO: But they ARE out of work!!!

ABBOTT: No, you miss my point.

COSTELLO: What point?

ABBOTT: Someone who doesn’t look for work, can’t be counted with those who look for work. It wouldn’t be fair.

COSTELLO: To whom?

ABBOTT: The unemployed.

COSTELLO: But they are ALL out of work.

ABBOTT: No, the unemployed are actively looking for work… Those who are out of work stopped looking. They gave up. And, if you give up, you are no longer in the ranks of the unemployed.

COSTELLO: So if you’re off the unemployment roles, that would count as less unemployment?

ABBOTT: Unemployment would go down. Absolutely!

COSTELLO: The unemployment just goes down because you don’t look for work?

ABBOTT: Absolutely it goes down. That’s how you get to 9%. Otherwise, it would be 20%. You don’t want to read about 20% unemployment do ya?

COSTELLO: That would be frightening.

ABBOTT: Absolutely.

COSTELLO: Wait, I got a question for you. That means they’re two ways to bring down the unemployment number?

ABBOTT: Two ways is correct.

COSTELLO: Unemployment can go down if someone gets a job?

ABBOTT: Correct.

COSTELLO: And unemployment can also go down if you stop looking for a job?

ABBOTT: Bingo.

COSTELLO: So there are two ways to bring unemployment down, and the easier of the two is to just stop looking for work.

ABBOTT: Now you’re thinking like a politician.

COSTELLO: I don’t even know what I just said!

Fight of the Century: Keynes vs. Hayek Round Two

An entertaining parody of the mindset of many of today’s economists. Also a great illustration of network externalities.

$5 Gas Not Likely, Says Texas A&M Expert

Having to dig deeper to fill up the gas tank? You are not alone as gas prices have steadily risen in the past few weeks, but the possibility of gas hitting $5 a gallon by summer as many analysts are predicting is very unlikely, says a Texas A&M University economist who has studied oil prices for decades.

John Moroney, professor of economics and an oil analyst for more than 30 years, says the possibility of gas reaching $4 a gallon from its current national average of around $3.45 is possible in the next few months, but not all that likely. As for gas hitting five bucks a gallon, don’t lose sleep about it, he advises.

“It is true prices have gone up in the last month or so,” he explains.

“Oil prices are now about $100 or so a barrel. For gas to cost $5 a gallon, prices would have to be in the $140-150 a barrel range, and I just don’t see it happening. A series of things would have to happen for that to occur, and I just don’t think it is very likely.”

Moroney has spent much of his career charting oil ups and downs. He authored Power Struggle: World Energy in the 21st Century, a book about energy demands and production several years ago.

One big reason he thinks oil prices will not rise too much over the next few months: oil production is on the rise.

New discoveries of huge oil reserves have been made in the last few years, and production of oil from shale has risen dramatically all over the U.S. and other countries. Gas prices hit a record of $4.11 a gallon in July 2008, and Moroney says he remembers “that time well because West Texas intermediate crude hit $147 a barrel.”

As for now, Moroney notes, “Shale production has been going extremely well and it is leading to more oil in the marketplace,” he says.

“For that reason alone, I don’t think you will see any dramatic shortages happen any time soon.

“The price increases over the past few weeks are fairly normal price fluctuations of oil. Could gas go to $4? It is possible, but not a certainty. Could it go to $5? I just don’t see it happening.

“You have to remember that for the oil producers in the Middle East, their very lives and economies depend on oil. They need the markets to be fairly stable. It is true demand is increasing, but then so is production of oil.

“One thing I have learned over the past 30 years is that predicting oil prices is very, very difficult to do because oil is so sensitive to world events,” he notes. “It is one of the most unpredictable commodities in the world. But I don’t see any huge gas price increases in the near future.”

3 misconceptions that need to die

HT to Sid Raisch for this link — http://www.fool.com/investing/general/2011/10/25/3-misconceptions-that-need-to-die.aspx, Morgan Housel, October 25, 2011

At a conference in Philadelphia earlier this month, a Wharton professor noted that one of the country’s biggest economic problems is a tsunami of misinformation. You can’t have a rational debate when facts are so easily supplanted by overreaching statements, broad generalizations, and misconceptions. And if you can’t have a rational debate, how does anything important get done? As author William Feather once advised, “Beware of the person who can’t be bothered by details.” There seems to be no shortage of those people lately.

At a conference in Philadelphia earlier this month, a Wharton professor noted that one of the country’s biggest economic problems is a tsunami of misinformation. You can’t have a rational debate when facts are so easily supplanted by overreaching statements, broad generalizations, and misconceptions. And if you can’t have a rational debate, how does anything important get done? As author William Feather once advised, “Beware of the person who can’t be bothered by details.” There seems to be no shortage of those people lately.

Here are three misconceptions that need to be put to rest.

Misconception: Most of what Americans spend their money on is made in China.

Fact: Just 2.7% of personal consumption expenditures go to Chinese-made goods and services. 88.5% of U.S. consumer spending is on American-made goods and services.

I used that statistic in an article last week, and the response from readers was overwhelming:Hogwash. People just didn’t believe it.

The figure comes from a Federal Reserve report. You can read it here.

A common rebuttal I got was, “How can it only be 2.7% when almost everything in Wal-Mart(NYSE: WMT ) is made in China?” Because Wal-Mart’s $260 billion in U.S. revenue isn’t exactly reflective of America’s $14.5 trillion economy. Wal-Mart might sell a broad range of knickknacks, many of which are made in China, but the vast majority of what Americans spend their money on is not knickknacks.

The Bureau of Labor Statistics closely tracks how an average American spends their money in an annual report called the Consumer Expenditure Survey. In 2010, the average American spent 34% of their income on housing, 13% on food, 11% on insurance and pensions, 7% on health care, and 2% on education. Those categories alone make up nearly 70% of total spending, and are comprised almost entirely of American-made goods and services (only 7% of food is imported, according to the USDA).

Even when looking at physical goods alone, Chinese imports still account for just a small fraction of U.S. spending. Just 6.4% of nondurable goods — things like food, clothing and toys — purchased in the U.S. are made in China; 76.2% are made in America. For durable goods — things like cars and furniture — 12% are made in China; 66.6% are made in America.

Another way to grasp the value of Chinese-made goods is to look at imports. The U.S. is on track toimport $340 billion worth of goods from China this year, which is 2.3% of our $14.5 trillion economy. Is that a lot? Yes. Is it most of what we spend our money on? Not by a long shot.

Part of the misconception is likely driven by the notion that America’s manufacturing base has been in steep decline. The truth, surprising to many, is that real manufacturing output today is near an all-time high. What’s dropped precipitously in recent decades is manufacturing employment. Technology and automation has allowed American manufacturers to build more stuff with far fewer workers than in the past. One good example: In 1950, a U.S. Steel (NYSE: X ) plant in Gary, Ind., produced 6 million tons of steel with 30,000 workers. Today, it produces 7.5 million tons with 5,000 workers. Output has gone up; employment has dropped like a rock.

Misconception: We owe most of our debt to China.

Fact: China owns 7.8% of U.S. government debt outstanding.

As of August, China owned $1.14 trillion of Treasuries. Government debt stood at $14.6 trillion that month. That’s 7.8%.

Who owns the rest? The largest holder of U.S. debt is the federal government itself. Various government trust funds like the Social Security trust fund own about $4.4 trillion worth of Treasury securities. The Federal Reserve owns another $1.6 trillion. Both are unique owners: Interest paid on debt held by federal trust funds is used to cover a portion of federal spending, and the vast majority of interest earned by the Federal Reserve is remitted back to the U.S. Treasury.

The rest of our debt is owned by state and local governments ($700 billion), private domestic investors ($3.1 trillion), and other non-Chinese foreign investors ($3.5 trillion).

Does China own a lot of our debt? Yes, but it’s a qualified yes. Of all Treasury debt held by foreigners, China is indeed the largest owner ($1.14 trillion), followed by Japan ($937 billion) and the U.K. ($397 billion).

Right there, you can see that Japan and the U.K. combined own more U.S. debt than China. Now, how many times have you heard someone say that we borrow an inordinate amount of money from Japan and the U.K.? I never have. But how often do you hear some version of the “China is our banker” line? Too often, I’d say.

Misconception: We get most of our oil from the Middle East.

Fact: Just 9.2% of oil consumed in the U.S. comes from the Middle East.

According the U.S. Energy Information Administration, the U.S. consumes 19.2 million barrels of petroleum products per day. Of that amount, a net 49% is produced domestically. The rest is imported.

Where is it imported from? Only a small fraction comes from the Middle East, and that fraction has been declining in recent years. So far this year, imports from the Persian Gulf region — which includes Bahrain, Iran, Iraq, Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates — have made up 9.2% of total petroleum supplied to the U.S. In 2001, that number was 14.1%.

The U.S. imports more than twice as much petroleum from Canada and Mexico than it does from the Middle East. Add in the share produced domestically, and the majority of petroleum consumed in the U.S. comes from North America.

This isn’t to belittle our energy situation. The nation still relies on imports for about half of its oil. That’s bad. But should the Middle East get the attention it does when we talk about oil reliance? In terms of security and geopolitical stability, perhaps. In terms of volume, probably not.

A roomful of skeptics

“People will generally accept facts as truth only if the facts agree with what they already believe,” said Andy Rooney. Do these numbers fit with what you already believed? No hard feelings if they don’t. Just let me know why in the comment section below.

Fool contributor Morgan Housel owns shares of Wal-Mart. Follow him on Twitter @TMFHousel. The Motley Fool owns shares of Wal-Mart Stores. Motley Fool newsletter services have recommended buying shares of and creating a diagonal call position in Wal-Mart Stores. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Reducing future deficits while stimulating today's economy

How can Congress reduce future deficits while stimulating today’s economy? University of Delaware economist Laurence Seidman argues that legislators should enact a budget that maintains balance under normal unemployment levels, and a fiscal stimulus package with a clause that phases out the package as the economy returns to full employment. Want to read more? Click here.

The Case for Optimism

From today’s Wall Street Journal article “The Case for Optimism” by Ross Devol, executive director of economic research at the Milken Institute:

Gloom and doom is the hallmark of the current economic debate, as the most recent congressional testimony from Federal Reserve Chairman Ben Bernanke demonstrates. Despite Mr. Bernanke’s generally upbeat message on the Fed’s official forecast, which calls for moderate economic growth of somewhere between 3.0% to 3.5% this year, the market and the media fixated on his acknowledgment that the outlook was “unusually uncertain.” Those words have only reverberated in the past few weeks, bolstering economic pessimists.

There’s a point at which pessimism becomes a self-fulfilling prophesy, scaring businesses away from investing or hiring. The dark tone of today’s discourse is at risk of doing just that.

The Milken Institute’s new study, “From Recession to Recovery: Analyzing America’s Return to Growth” is based on extensive and dispassionate econometric analysis. It concludes that the U.S. economy remains more flexible and resilient—and has more underlying momentum—than is generally acknowledged. In fact, our projections show cause for measured optimism: A return to modest but sustainable growth is close at hand.

America’s businesses are capable of navigating around policy uncertainty and the twists and turns of a volatile global economy. While slow private-sector job growth is to be expected in the early stages of a recovery, the U.S. should add 1.5 million jobs in 2010, 3.1 million in 2011, and 2.6 million in 2012. That will translate into real GDP growth of 3.3% in 2010, 3.7% in 2011, and 3.8% in 2012.

In this pessimistic climate, this forecast will likely be considered contrarian. So why is our economic outlook more sanguine than the current consensus? For one, robust (albeit moderating) economic growth in developing countries, particularly in Asia, will provide support for U.S. exports. Look no further than Caterpillar, which reported a doubling of its earnings in the second quarter of 2010 and whose product line is sold out for the rest of the year.

Improved business confidence is already spurring strong investment in equipment and software. Record-low U.S. long-term interest rates are supporting the recovery. And the benign inflationary environment allows the Fed to keep short-term interest rates near zero until late this year, or even into 2011 if it desires.

Historical context offers further reason to expect a rebound. The peak-to-trough decline in real GDP during this recession was 4.1%, making it the most severe downturn since World War II. But throughout the postwar period, the rate of economic recovery from past recessions has been proportional to the depth of the decline experienced. While this relationship has been somewhat variable, it is well-established. Our projections for GDP growth are above consensus but are substantially below a normal rate of recovery after a recession of this severity.

The naysayers are right that there’s a “new normal” economy, but it’s not that the potential long-term growth rate of the U.S. is substantially diminished, as they say. It’s that this time, the fulfillment of pent-up demand will be subdued because consumers were living so far above their means during the bubble years. Nevertheless, consumer durables and business investment in equipment will see some previously postponed purchases finally happen—if not this year, certainly by 2011 and 2012.

What needs to happen on the policy front in order to build momentum?

In the first place, small businesses need access to more bank credit to create jobs. Banks feel conflicted by calls from the Obama administration to increase lending while regulators are instructing them to add to their reserves. Regulators need to be reminded that some risk is necessary in a market economy.

The White House also should press Congress to pass legislation modernizing Cold War–era restrictions on exports of technology products and services that are already commercially available from our allies. This would boost U.S. exports and reduce the deficit. And if the White House is serious about doubling exports by 2015, it needs to push trade deals with South Korea, Colombia and Costa Rica through Congress.

For its part, Congress must move immediately to restore the lapsed R&D tax credit. Even better, it should expand the credit and make it permanent.

Congress also should pass legislation to temporarily extend the Bush tax cuts that are set to expire at the end of this year. It’s important not to remove any economic stimulus as long as the sustainability of the recovery is in question.

Another must-do: by 2012, Congress needs a credible long-term plan in place to reduce the deficit. If it doesn’t, international financial markets might force our hand by demanding a higher rate of return on U.S. Treasurys.

Washington has to focus like a laser on helping businesses create jobs, while the rest of us should avoid talking ourselves out of a recovery by dwelling on the doom and gloom. The U.S. economy has already adapted to serious imbalances in record time: There’s ample reason to believe in its dynamism in the months and years ahead.

Mr. DeVol is executive director of economic research at the Milken Institute, a nonprofit economic think tank based in Santa Monica, CA.

See related excellent post today from Scott Grannis: “20 Bullish Charts.”

Economy still mixed

It could’ve shaped up to be a good week. After all, the Senate pushed through a vote on bank reform, bellwether earnings weren’t all that bad, BP finally seems to have halted the spewing oil in the Gulf, the Northeast got a small reprieve from the heat wave — and last but not least — Apple announced plans to rectify “Antennagate.” Nevertheless, U.S. stocks ended the week on a sour note, as the Dow Jones Industrial Average plunged more than 250 points Friday.

Bank reform moves ahead. This week, the Senate approved the most historic shakeup of the regulation of U.S. banks since the Great Depression. The legislation would place new fees and restrictions on the nation’s biggest banks, impose new restrictions on the Federal Reserve and craft a major new consumer-protection division for mortgage and credit-card products. Read more about the bank-reform legislation .

Just-in-case stimulus. Federal Reserve officials agreed it would be a good idea to study what to do if the economy were to worsen severely, according to a summary of June’s closed-door meeting released this week. Officials said the outlook for the recovery had softened between April and June, but changes to their forecast were “relatively modest” and “not warranting policy accommodation beyond that already in place.” Read more about the Fed minutes .

BP cap seems to be holding. BP shares (BP) slipped Friday as euphoria over the company’s apparent success in stopping the flow of crude from its ruptured well gave way to the realities surrounding the worst oil spill in U.S. history. In its latest update, BP said the well cap continues to hold. But the ruptured well isn’t dead yet, prompting a cautious tone from President Obama in his remarks on the spill. Read more about BP’s efforts to contain the leak .

Also, the latest from Bill Conerly.

Inflation remains low as retail sales and housing starts rise

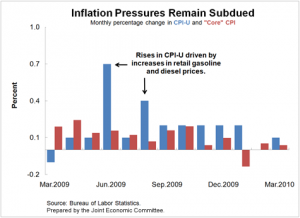

Inflation Remains Subdued. The Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U), a key measure of inflation, rose by 0.1 percent in March. Core CPI-U, which excludes the food and energy categories and is a less volatile measure of inflation, remained unchanged in March relative to February. This follows the general pattern of low inflation that has persisted since the start of the recession, and projections by the Administration, the Federal Reserve, and the Congressional Budget Office all suggest that inflation will remain low at least through 2012. The low inflation reading should allay concerns that the economy is in danger of experiencing high levels of inflation that may cause the Fed to raise the federal funds rate sooner than otherwise expected.

Inflation Remains Subdued. The Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U), a key measure of inflation, rose by 0.1 percent in March. Core CPI-U, which excludes the food and energy categories and is a less volatile measure of inflation, remained unchanged in March relative to February. This follows the general pattern of low inflation that has persisted since the start of the recession, and projections by the Administration, the Federal Reserve, and the Congressional Budget Office all suggest that inflation will remain low at least through 2012. The low inflation reading should allay concerns that the economy is in danger of experiencing high levels of inflation that may cause the Fed to raise the federal funds rate sooner than otherwise expected.

The low inflation reading should allay concerns that the economy is in danger of experiencing high levels of inflation that may cause the Fed to raise the federal funds rate sooner than otherwise expected. However, many economists remained concerned about the potential impact of oil price rises on inflation and the nascent recovery.

Retail Sales Picking Up. Retail Sales Picking Up. Retail and food service sales rose by 1.6 percent in March, according to advance estimates released by the Census Bureau. The total sales of $363.2 billion in March was 7.6 percent higher than sales were in March 2009. The Census Bureau also revised its February sales growth estimate from 0.3 percent to 0.5 percent. Among the categories of products whose sales grew in March relative to February were motor vehicles and parts (up 7.6 percent), building materials and supplies (up 3.1 percent), and furniture and home furnishings (up 1.6 percent). The sales growth in those last two sectors is consistent with the end of the decline in demand for housing, which seems to have stabilized in the past few months. Even excluding sales of motor vehicles and parts, retail and food service sales grew by 0.6 percent.

Housing Starts Increase Overall, But Decrease For Single-Family Homes. The number of new housing units started in March increased for the third consecutive month by 1.6 percent. The annualized number of new housing units started, seasonally adjusted, is now 626,000 units, the highest since November 2008 but well below the peak of 2.3 million housing units started at the height of the housing boom. However, March’s increase in housing starts was driven by new multi-family dwelling units, which are much more volatile than single-family housing units. The number of multi-family dwelling units started in March increased by 18.8 percent while the number of single-family houses declined by almost 1 percent. On the housing demand side, home builders are hoping for strong sales in April as the first-time home buyer tax credit is set to expire at the end of the month.