The latest from Bill Conerly:

Source:

Source:

Bill Conerly

by Charlie

The latest from Bill Conerly:

Source:

Source:

Bill Conerly

by Charlie

An excerpt from Ben Bernanke’s speech at the University of South Carolina Commencement Ceremony, Columbia, South Carolina, May 8, 2010:

Notwithstanding that income contributes to well-being, the economics of happiness is also a useful antidote to the tendency of economists to focus exclusively on material determinants of social welfare, such as the GDP. GDP is not itself the final objective of policy, just as an increase in income may not be a good enough reason for you to change jobs. Obtaining broader measures of human welfare is challenging, but not impossible…

But even though GDP or income should not be the only goal of our strivings, we can go one step further and recognize as well that happiness itself, at least to the extent that the term is associated with immediate rather than long-lasting feelings and emotions, should not be our only goal either. Remember that I began by distinguishing between happiness and life satisfaction. Happiness is just one component of the broader, longer-term concept of life satisfaction, and only one indicator of how the fabric of our lives is being shaped by our choices and circumstances.

I am reminded of a story about Abraham Lincoln. According to the story, Lincoln was riding with a friend in a carriage on a rainy evening. As they rode, Lincoln told the friend that he believed in what economists would call the utility-maximizing theory of behavior, that people always act so as to maximize their own happiness, and for no other reason. Just then, the carriage crossed a bridge, and Lincoln saw a pig stuck in the muddy riverbank. Telling the carriage driver to stop, Lincoln struggled through the rain and mud, picked up the pig, and carried it to safety. When the muddy Lincoln returned to the carriage, his friend naturally pointed out that he had just disproved his own hypothesis by putting himself to great trouble and discomfort to save a pig. “Not at all,” said Lincoln. “What I did is perfectly consistent with my theory. If I hadn’t saved that pig, I would have felt terrible.”

The story points out that, sometimes, happiness is nature’s way of telling us we are doing the right thing. True. But, by the same token, ephemeral feelings of happiness are not always reliable indicators we are on the right path. Ultimately, life satisfaction requires more than just happiness. Sometimes, difficult choices can open the doors to future opportunities, and the short-run pain can be worth the long-run gain. Just as importantly, life satisfaction requires an ethical framework. Everyone needs such a framework. In the short run, it is possible that doing the ethical thing will make you feel, well, unhappy. In the long run, though, it is essential for a well-balanced and satisfying life.

by Charlie

The 25th annual Seeley conference is only 7 weeks away (June 26-29, 2010 in Ithaca, NY) and there are a few seats left. This year’s theme is: Floriculture’s Environmental Footprint: An Inconvenient Truth or Consumer Opportunity?

For several years, we’ve heard about global warming and climate change as issues we need to address. Of course, the real issues revolve around what it means for the bottom line for our individual businesses. How will the outcomes of the current legislative debate impact us? Are there modifications we need to make to stay in business once the debate ends and the laws are enacted? Will our businesses be able to remain financially solvent or will regulations force us out of business? These are but a few of the critical questions this year’s conference will address and the think-tank atmosphere of the Seeley Conference will allow for plenty of interaction with fellow industry leaders.

Kicking off the conference is Dr. Rob Stavins who is Director of the Harvard University’s Environmental Economics Program. A second keynote will be delivered by Joel Makower, Executive Editor of GreenBiz.com, whom the Associated Press refers to as the “guru of green business practices.” Steve Windhager of the Ladybird Johnson Wildflower Center closes the first day with an overview of the newly released Sustainable Sites Initiative guidelines.

The second day starts with case study presentations by representatives from Walmart and the Food Marketing Institute relating their respective sustainability experiences. This will be followed up with detailed presentations from Kaji Kado of PPD Technologies and Will Healy from Ball Horticulture with each of them discussing procedures for calculating water and carbon footprints using life cycle analysis. The day will wrap up with case study discussions from floriculture and nursery industry leaders regarding their respective successes and challenges in this area.

The closing keynote address on the last morning of the conference will be given by Robert Dolibois, Executive Vice President of the American Nursery & Landscape Association (ANLA) who will highlight the responses made by green industry participants in addressing environmental issues, the importance of consumer and legislator perceptions about our products and services, and what is being done in the industry to convey our value proposition of enhancing the lives of consumers through ecosystems services and other benefits (health, aesthetics, economic, etc). The final speaker on the program will be Fred Haberman who will lead attendees in a discussion of how best to tell their story regarding their sustainability-related business practices.

As always, the think-tank atmosphere of the Seeley Conference will allow for plenty of interaction with fellow industry leaders regarding these timely issues. One of the objectives of the conference is for attendees to have a very concrete, well-defined plan for addressing the issues discussed as they go back to their respective businesses. This year promises to not only do that but provide a very necessary primer on this critical issue facing the industry.

To register online and to find more information regarding the 2010 Seeley Conference and this year’s program, the conference website is www.hort.cornell.edu/seeleyconference, or Facebook users can refer to the Seeley Conference fan page.

by Charlie

When things were going well, it was said that the United States enjoyed a Goldilocks Economy. Growth was fast enough to produce jobs and higher incomes but not so fast as to generate inflation. In the same vein, it might be said that today we have an Oscar-the-Grouch Economy. Good news is discounted. Pessimism is trendy. Growth is considered too feeble to help real people. But there is some genuine good news — and it deserves attention.

It’s most obvious in the labor market. The increase of 162,000 payroll jobs in March was the largest in three years. Layoffs have subsided to pre-recession levels. Job openings have ended their precipitous decline. Surveys suggest more gains. A poll of the corporate chief executives in the Business Roundtable found that 29 percent expect to increase jobs over the next six months, and only 21 percent expect to cut; not since the fall of 2008 have more CEOs expected to hire than fire. In March, the National Federation of Independent Business, a trade group for small firms, found no net job cuts — the first time that’s happened since April 2008.

What’s also encouraging is that the recession’s severity has left much pent-up demand. Mark Zandi of Moody’s Economy.com reckons that the underlying need for housing (new households, destruction of older homes) totals about 1.85 million units a year. Meanwhile, home and apartment construction is running at only about 600,000 a year. “We’re working down a high inventory of unsold homes,” says Zandi, “but housing will come back.” The same logic applies to cars and trucks: Sales collapsed from 16.2 million in 2007 to 10.4 million in 2007 to 10.4 million in 2009. They’re bound to rise.

A final favorable omen is corporate America’s strong cash position, reflecting deep cuts in jobs and capital spending, says economist Nariman Behravesh of IHS Global Insight, a forecasting firm. In 2009, business cash flow equaled 11 percent of gross domestic product, the highest in at least half a century. As companies gain confidence that the worst is past, they have the cash “to make a bet on recovery” by restarting canceled investment projects, says Behravesh. IHS Global Insight expects business spending on machinery, computers and software to increase 9.6 percent in 2010.

One cause of pessimism is that the U.S. economy is undergoing a fundamental change — and it’s unclear how successful the transition will be. Beginning in the 1980s, American prosperity depended increasingly on a debt-financed expansion of consumer spending and housing, as the Economist’s Greg Ip notes in a recent survey of the economy. In 1991, consumer spending and housing accounted for 70 percent of GDP; by 2005, their share was 76 percent. That boost has ended, because many families overborrowed, overspent and undersaved.

As Americans repay debt and shore up savings, consumer spending and housing weaken. In 2009, their share of GDP had already dropped to 73 percent. So the U.S. economy needs another growth engine. Exports and related investment are obvious candidates. This includes both expensive equipment (Caterpillar bulldozers, Intel chips) and sophisticated services (architectural designs, oil and gas drilling). But no one knows how well exports will do. Protectionism could flourish if, as Ip notes, “every country [looks] to exports to lead its recovery.” The deeper source of pessimism is the trauma inflicted by the economic slump. Unlike other post-World War II recessions, upper-income families shared the fear, as their stocks and housing wealth collapsed and their jobs vanished or seemed threatened. Overall payroll job losses of 8.4 million have been devastating in magnitude and duration. Among the unemployed, 44 percent have been without work half a year or more; the previous peak for comparable joblessness was 26 percent in June 1983. About half of unemployed workers 45 to 64 have been out of work for six months or more; for a third, unemployment has lasted more than a year. Almost any mature worker who’s lost a job has struggled to find a replacement.

Life plans have unraveled. The Wall Street Journal recently profiled a six-figure investment manager who’d been laid off by General Electric, couldn’t find a new job and worried about how to send his youngest daughter to college. Public psychology has darkened, because most upsets were unanticipated. People and companies have become more cautious, hedging against what they don’t know. If the unexpected happened once, it could happen again.

The concerns aren’t unrealistic, especially considering America’s long-term problems (budget deficits, an aging society, weak state and local governments). Still, the glumness may be overdone, just as the optimism of the Goldilocks Economy was overdone. Public mood swings move the economy. The irony of today’s pervasive pessimism is that, as people’s worst fears are not realized, it could begin to lift and give the economy a surprising forward shove.

Source: Robert Samuelson, Washington Post.

by Charlie

Dr. Rob Stavins will provide the opening keynote at this year’s Seeley Conference (registration is now open for the conference which will be held June 27-29 in Ithaca, NY). Below are comments he made yesterday in his Harvard University blog:

![]()

In just a few days, Senators John Kerry, Lindsey Graham, and Joe Lieberman will release their much-anticipated proposal for comprehensive climate and energy legislation – the best remaining shot at forging a bipartisan consensus on this issue in 2010. Their proposal has many strengths, but there’s an issue brewing that could undermine its effectiveness and drive up its costs. I wrote about this in a Boston Globe op-ed on Earth Day, April 22nd (the original version of which can be downloaded here).

Government officials from California, New England, New York, and other northeastern states are vociferously lobbying in Washington to retain their existing state and regional systems for reducing greenhouse gas emissions, even after a new federal system comes into force. That would be a mistake – and a potentially expensive one for residents of those states, who could wind up subsidizing the rest of the country. The Senate should do as the House did in its climate legislation: preempt state and regional climate policies. There’s no risk, because if Federal legislation is not enacted, preemption will not take effect.

The regional systems – including the Regional Greenhouse Gas Initiative (RGGI) in the Northeast and Assembly Bill 32 in California – seek to limit carbon dioxide emissions from power plants and other sources, mainly by making emissions more costly for firms and individuals. These systems were explicitly developed because the federal government was not moving fast enough.

But times have changed. Like the House climate legislation passed last June, the new Senate bill will feature at its heart an economy-wide carbon-pricing scheme to reduce carbon dioxide emissions, including a cap-and-trade system (under a different name) for the electricity and industrial sectors. (In a departure from the House version, it may have a carbon fee for transportation fuels.)

Though the Congress has a history of allowing states to act more aggressively on environmental protection, this tradition makes no sense when it comes to climate change policy. For other, localized environmental problems, California or Massachusetts may wish to incur the costs of achieving cleaner air or water within their borders than required by a national threshold. But with climate change, it is impossible for regions, states, or localities to achieve greater protection for their jurisdictions through more ambitious actions.

This is because of the nature of the climate change problem. Greenhouse gases, including carbon dioxide, uniformly mix in the atmosphere – a unit of carbon dioxide emitted in California contributes just as much to the problem as carbon dioxide emitted in Tennessee. The overall magnitude of damages – and their location – are completely unaffected by the location of emissions. This means that for any individual jurisdiction, the benefits of action will inevitably be less than the costs. (This is the same reason why U.S. federal action on climate change should occur at the same time as other countries take actions to reduce their emissions).

If federal climate policy comes into force, the more stringent California policy will accomplish no additional reductions in greenhouse gases, but simply increase the state’s costs and subsidize other parts of the country. This is because under a nationwide cap-and-trade system, any additional emission reductions achieved in California will be offset by fewer reductions in other states.

A national cap-and-trade system – which is needed to address emissions meaningfully and cost-effectively – will undo the effects of a more stringent cap within any state or group of states. RGGI, which covers only electricity generation and which will be less stringent than the Federal policy, will be irrelevant once the federal system comes into force.

In principle, a new federal policy could allow states to opt out if they implement a program at least as stringent. But why should states want to opt out? High-cost states will be better off joining the national system to lower their costs. And states that can reduce emissions more cheaply will be net sellers of Federal allowances.

Is there any possible role for state and local policies? Yes. Price signals provided by a national cap-and-trade system are necessary to meaningfully address climate change at sensible cost, but such price signals are not sufficient. Other market failures call for supplementary policies. Take, for example, the principal-agent problem through which despite higher energy prices, both landlords and tenants lack incentives to make economically-efficient energy-conservation investments, such as installing thermal insulation. This problem can be handled by state and local authorities through regionally-differentiated building codes and zoning.

But for the core of climate policy – which is carbon pricing – the simplest, cleanest, and best way to avoid unnecessary costs and unnecessary actions is for existing state systems to become part of the federal system. Political leaders from across the country – including the Northeast and California – would do well to follow the progressive lead of Massachusetts Governor Deval Patrick and Secretary of Energy and Environmental Affairs Ian Bowles, who have played key roles in the design and implementation of RGGI, and yet have also publicly supported its preemption by a meaningful national program.

California’s leaders and those in the Northeast may take great pride in their state and regional climate policies, but if they accomplish their frequently-stated goal – helping to bring about the enactment of a meaningful national climate policy – they will better serve their states and the country by declaring victory and getting out of the way.

by Charlie

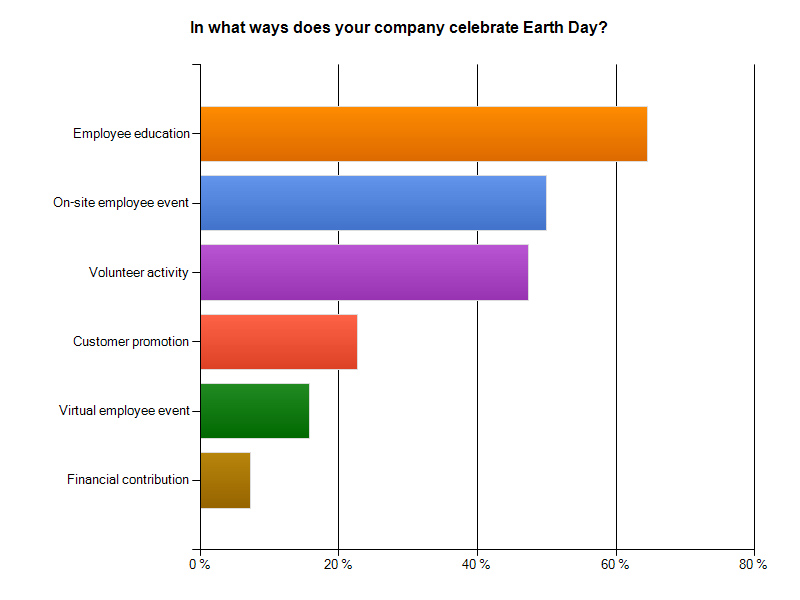

In order to get a look at how Earth Day is celebrated by business, Greenbiz.com sent a short survey to their GreenBiz Intelligence Panel, a group of more than 2,000 executives and thought leaders in the area of corporate environmental strategy and performance. Some examples of on-site events for employees include movie screenings (“No Impact Man,” “Garbage! The Revolution Starts at Home“), competitions for personal sustainability efforts, company-wide lunches, bike-to-work days, and dumpster dives to showcase the amount of waste a company creates. Other companies encourage their employees to volunteer in the community and/or for the environment on Earth Day; some contribute money to environmental causes, and some host customer- and public-facing events highlighting green projects and products that individuals can do every day. The chart below summarizes their findings:

by Charlie

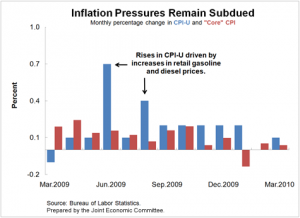

Inflation Remains Subdued. The Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U), a key measure of inflation, rose by 0.1 percent in March. Core CPI-U, which excludes the food and energy categories and is a less volatile measure of inflation, remained unchanged in March relative to February. This follows the general pattern of low inflation that has persisted since the start of the recession, and projections by the Administration, the Federal Reserve, and the Congressional Budget Office all suggest that inflation will remain low at least through 2012. The low inflation reading should allay concerns that the economy is in danger of experiencing high levels of inflation that may cause the Fed to raise the federal funds rate sooner than otherwise expected.

Inflation Remains Subdued. The Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U), a key measure of inflation, rose by 0.1 percent in March. Core CPI-U, which excludes the food and energy categories and is a less volatile measure of inflation, remained unchanged in March relative to February. This follows the general pattern of low inflation that has persisted since the start of the recession, and projections by the Administration, the Federal Reserve, and the Congressional Budget Office all suggest that inflation will remain low at least through 2012. The low inflation reading should allay concerns that the economy is in danger of experiencing high levels of inflation that may cause the Fed to raise the federal funds rate sooner than otherwise expected.

The low inflation reading should allay concerns that the economy is in danger of experiencing high levels of inflation that may cause the Fed to raise the federal funds rate sooner than otherwise expected. However, many economists remained concerned about the potential impact of oil price rises on inflation and the nascent recovery.

Retail Sales Picking Up. Retail Sales Picking Up. Retail and food service sales rose by 1.6 percent in March, according to advance estimates released by the Census Bureau. The total sales of $363.2 billion in March was 7.6 percent higher than sales were in March 2009. The Census Bureau also revised its February sales growth estimate from 0.3 percent to 0.5 percent. Among the categories of products whose sales grew in March relative to February were motor vehicles and parts (up 7.6 percent), building materials and supplies (up 3.1 percent), and furniture and home furnishings (up 1.6 percent). The sales growth in those last two sectors is consistent with the end of the decline in demand for housing, which seems to have stabilized in the past few months. Even excluding sales of motor vehicles and parts, retail and food service sales grew by 0.6 percent.

Housing Starts Increase Overall, But Decrease For Single-Family Homes. The number of new housing units started in March increased for the third consecutive month by 1.6 percent. The annualized number of new housing units started, seasonally adjusted, is now 626,000 units, the highest since November 2008 but well below the peak of 2.3 million housing units started at the height of the housing boom. However, March’s increase in housing starts was driven by new multi-family dwelling units, which are much more volatile than single-family housing units. The number of multi-family dwelling units started in March increased by 18.8 percent while the number of single-family houses declined by almost 1 percent. On the housing demand side, home builders are hoping for strong sales in April as the first-time home buyer tax credit is set to expire at the end of the month.

by Charlie

From the WSJ today:

U.S. retail sales surged in March, topping expectations and giving a strong sign consumers are growing more confident the economy is improving. Retail sales leaped by 1.6% last month, the Commerce Department said today. Economists surveyed by Dow Jones Newswires had forecast a 1.3% increase. The gain was the biggest in four months. Robust car sales drove the much of the better-than-expected increase in retail sales. Yet excluding the automotive sector, other retailers were strong as well. Clothing stores, for instance, saw sales jump by 2.3%. The report Wednesday was another suggestion that a pent-up demand from the recession is being unleashed within the recovering U.S. economy.

Here is a nice graph from Mark Perry showing the trend:

Another graph from EconompicData shows the strong building material and garden supplies category:

Another graph from EconompicData shows the strong building material and garden supplies category:

by Charlie

As you might have gathered in the last few days, the look and feel of the Ellison Chair website has changed and went live yesterday! Here are few of the notable changes:

Feel free to look around and if you have a minute, check out the quick tour by clicking on the video below:

by Charlie

Among the noteworthy news of the week, several examples of the continuing economic recovery include: