The OFA Short Course, Columbus Ohio

Saturday, July 10th8 AM – 12 PM

Crop Management Workshop: Keeping You & Your Customers Happy (4 hours)

Charles Hall, Texas A&M University

Michelle Jones, The Ohio State University, OARDC

Claudio Pasian, The Ohio State University

George Staby, Perishables Research Organization, Chain of Life Network

Terri Starman, Texas A & M University

Don’t keep throwing your money away. Plant losses (or shrinkage) during production, shipping and retailing negatively impact your bottom line. In this session, you will learn how to manage plant quality throughout the production and marketing chain so that you can realize maximum salability and profit from your crops. This session will look at how fertility, temperature, light, container design, growing media, wetting agents, hydrogels, packaging, transportation, and ethylene can affect the shelf life of bedding and potted plants. You will learn how the application of anti-ethylene compounds and abscisic acid based plant growth regulators can be used to enhance plant stress tolerance and increase plant survivability during shipping. If you produce or sell plants, you will not want to miss this valuable workshop.

The pre-registration price for OFA and ANLA members is $95; the non-member price is $120.

Details can be found on page 64 of the educational programs brochure at http://www.ofa.org/sessions.aspx

Registrations begins May 11, 2010

To register online go towww.ofa.org/reg

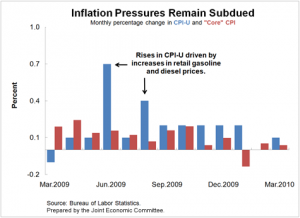

Inflation Remains Subdued. The Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U), a key measure of inflation, rose by 0.1 percent in March. Core CPI-U, which excludes the food and energy categories and is a less volatile measure of inflation, remained unchanged in March relative to February. This follows the general pattern of low inflation that has persisted since the start of the recession, and projections by the Administration, the Federal Reserve, and the Congressional Budget Office all suggest that inflation will remain low at least through 2012. The low inflation reading should allay concerns that the economy is in danger of experiencing high levels of inflation that may cause the Fed to raise the federal funds rate sooner than otherwise expected.

Inflation Remains Subdued. The Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U), a key measure of inflation, rose by 0.1 percent in March. Core CPI-U, which excludes the food and energy categories and is a less volatile measure of inflation, remained unchanged in March relative to February. This follows the general pattern of low inflation that has persisted since the start of the recession, and projections by the Administration, the Federal Reserve, and the Congressional Budget Office all suggest that inflation will remain low at least through 2012. The low inflation reading should allay concerns that the economy is in danger of experiencing high levels of inflation that may cause the Fed to raise the federal funds rate sooner than otherwise expected. Another graph from EconompicData shows the strong building material and garden supplies category:

Another graph from EconompicData shows the strong building material and garden supplies category: